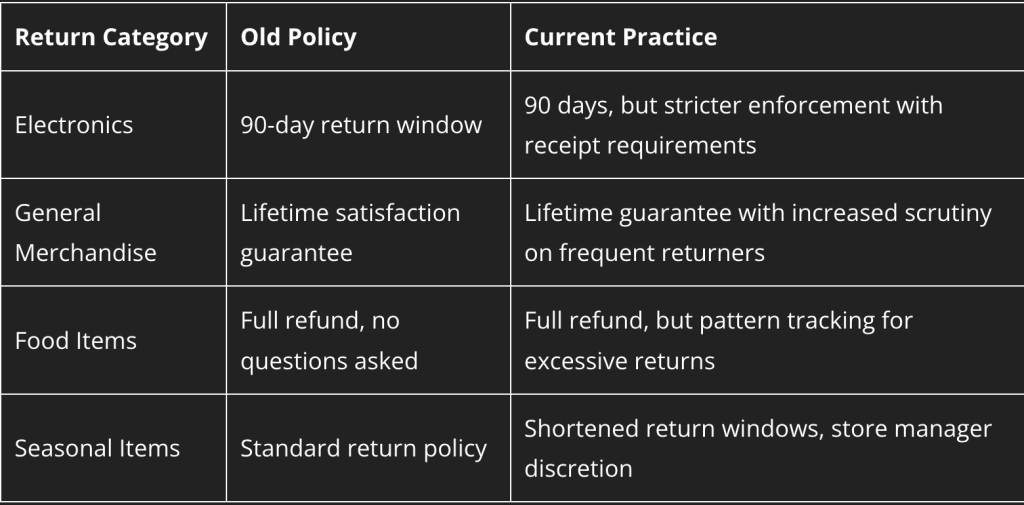

Costco has been known for taking almost anything back. This reputation helped build deep customer loyalty and even gave shoppers confidence when making large or bulk purchases. But recently, signs suggest that Costco returns are being handled with more caution than before.

Several members have pointed out that returns now take longer or require additional verification. In some cases, staff review account history before approving refunds. It should be noted that these reviews are not happening everywhere. But they incline towards a more structured approach behind the scenes. Former Costco manager Jennifer Walsh shed light on the latest upgrade and said,

“The reality is that a small percentage of members were abusing the return policy, and it was costing everyone. The company had to find a balance between maintaining customer satisfaction and protecting their bottom line.”

Also Read: SoundHound AI Stock: Is Agentic AI the Real Catalyst in 2026?

Costco Returns Policy Changes Raise Questions for COST Stock Outlook

The latest shift comes as retailers deal with increasing operational costs and increased return volumes. Handling returns is expensive. Products often cannot be resold immediately, and processing them requires time and labor. Even small changes in return behavior can affect profitability at scale.

That said, the core Costco returns policy remains customer-friendly. Most products can still be returned without strict deadlines, and membership continues to offer strong consumer protection. But the retail giant appears to be using internal tools to monitor return activity more actively. Elaborating on the same, retail analyst Michael Patterson said:

“We’ve definitely seen changes in how Costco handles returns over the past year. They’re being much more selective about what they’ll take back and from whom. The days of no-questions-asked returns are quietly coming to an end.”

It is worth noting that the firm’s focus on efficiency is central to its business model. Costco keeps its prices low by operating with tighter profit margins than traditional retailers.

Along with this, Costco is also updating its digital systems. The firm plans to allow customers to order cakes and deli trays directly through its app and website. Previously, members had to visit warehouses to place those orders in person. These changes point towards Costco’s intentions in modernizing operations.

Also Read: X Set To Launch Crypto And Stock Trading With Smart Cashtags

Costco Stock Price Forecast Remains Strong

Investors appear confident in Costco’s direction. The retail giant reported net sales of $66 billion in the first quarter of fiscal 2026 alone. Through this, Costco reinforced its position as one of the most dominant retail chains. It should be noted that the firm serves around 81 million member households across the globe.

Through the latest changes and upgrades COST stock price may see a boost. Looking back over the past five years, the COST stock price has delivered a total return of about 193%. Long-term investors are clearly reaping benefits. The firm also continued to open about 25 to 30 new warehouses every year. This aids in increasing Costco’s footprint and revenue potential.

Also Read: Illuvium Wave 5 Arrives: Final Set 1 Release Fuels Momentum

This consistent growth has helped shape a positive Costco stock price forecast, as analysts view the company as a stable player. COST stock closed at $1,018.48 on February 13, marking a 1.96% gain on the day. In after-hours trading, the stock slipped slightly to $1,016.20.