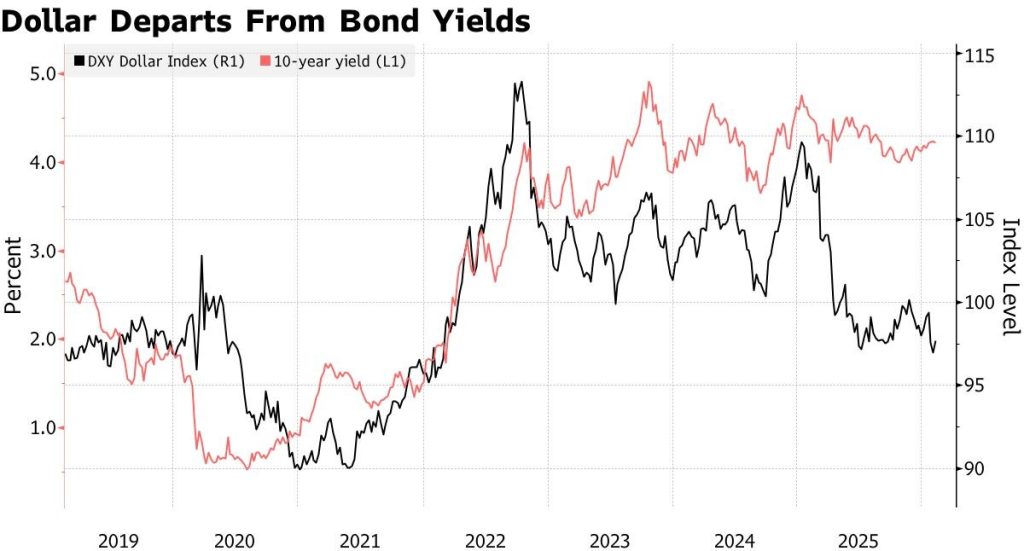

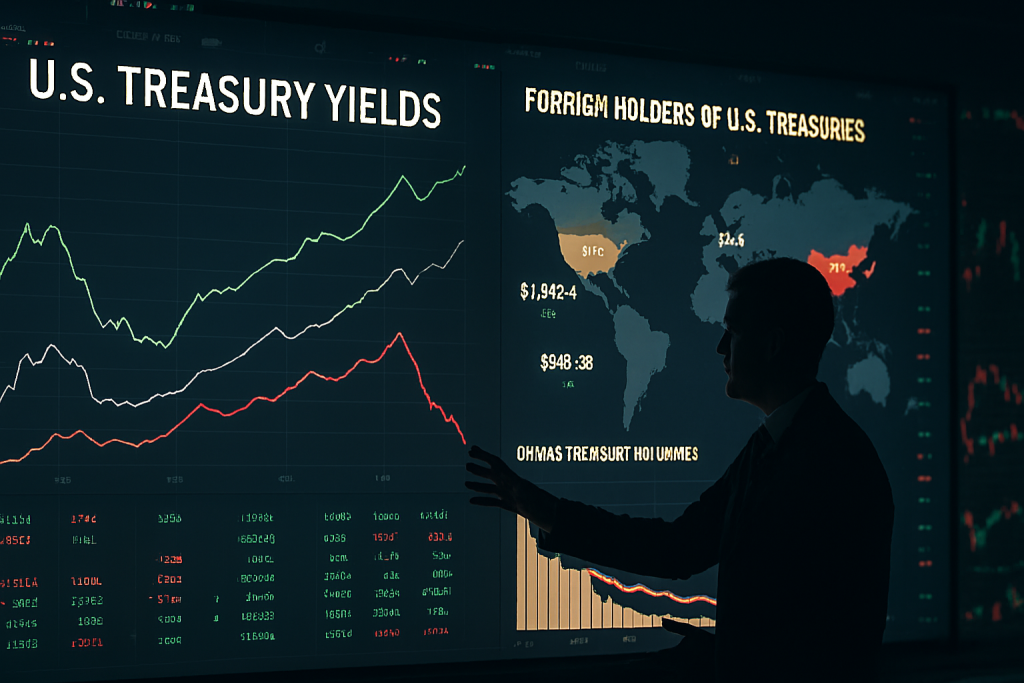

The US Dollar Index fell to 96.80, marking one of its weakest levels in recent sessions. This comes amid China urging its financial institutions to reduce holdings of US Treasuries. China’s holdings of the US Treasuries have declined sharply over the last decade, standing at $682.6 billion in November 2025, down from its all-time high of $1.32 trillion in 2013.

Also Read: MSFT Stock Faces Pressure as AI CapEx Surges Despite Earnings Beat

China’s Treasury Curbs Pressure Dollar Index and Global Bond Markets

The US Dollar Index, or DXY, is a measure of the value of the US dollar against six global currencies. These are the EUR (Euro), JPY (Japanese Yen), GBP (British Pound Sterling), CAD (Canadian Dollar), SEK (Swedish Krona), and CHF (Swiss Franc). A weaker US Dollar Index raises fears that foreign demand for dollar-backed assets may decrease.

According to a report by Bloomberg, China is cautioning its institutions to practice restraint in their purchase of US government bonds, citing market volatility and risk of concentration. Sources privy to the matter say that this is largely done to reduce high exposure to US Treasuries and diversify market risks, amid US debt reduction concerns. They say the advice has nothing to do with geopolitical financial tensions.

Even though the guidance was aimed at risk management, there’s a growing fear that it might add pressure to global bond markets.

Also Read: MrBeast’s Beast Industries Acquisition of Step App Transforms Gen Z Fintech

Analyst Views on China’s Treasury Sales and Global Yield Impact

Explaining the move by China, Kathleen Brooks from XTB said:

”If China was to ditch their Treasuries in a large-scale selling program, this would cause US and global yields to spike and would cause major disruption to the global economy.”

She added:

”The bond market is taking the view that China won’t do this, and if they do reduce the size of their Treasury holdings they will do this in a slow and gradual way. Hence why yields are mostly stable so far.”

According to the US Treasury data, Japan is currently the biggest foreign holder of US Treasury securities at $1202.6 billion. It’s followed by the United Kingdom at $888.5 billion. While China, with $682.6 billion, is third on the list. The same data shows foreign Treasury selling by China totalling $86 billion in the last year.

Also Read: Grocery Giant Kroger Appoints Ex-Walmart CEO Foran as Stock Surges 4%

During the same period, Belgium’s holdings in US Treasuries increased by $119.9 billion. Analysts attribute this to China reportedly moving part of its holdings to Europe. So, China’s selling of US Treasuries may not be as huge as the numbers suggest.