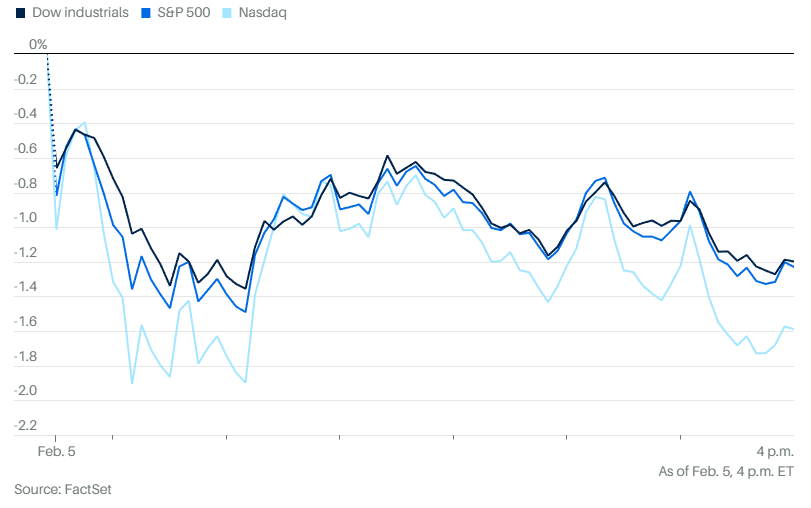

Dow Jones futures today gained 147 points, hitting 49,145, after falling for three consecutive days. The move comes after a sharp selloff triggered by corporate spending and stretched valuations.

The latest downturn was sparked by Amazon’s stock falling more than 10% after the Q4 earnings call, which is attributed to its AI spending and cloud infrastructure expansion plans, a move that unsettled investors

Also Read: Amazon Stock Drops After Earnings on Massive Capex Warning

AI-Push Behind the Market Fall

The February market volatility highlights risk reassessment by investors after months of optimism. Companies committing billions of dollars to AI-related investments, from data centers to custom chips, is a major pain point.

Amazon (AAMZ) and Alphabet (GOOG) Circumstances

Tech giants like Amazon and Alphabet see it as strategically necessary to expand. Amazon’s CEO, Andrew Jassy, during the Q4 earnings call said:

“With such strong demand for our existing offerings and seminal opportunities like AI, chips, robotics, and low earth orbit satellites, we expect to invest about $200 billion in capital expenditures across Amazon in 2026, and anticipate strong long-term return on invested capital.”

Also Read: Circle and Polymarket Partner to Integrate Native USDC Settlement

According to Reuters, Alphabet may double its capex spending in 2026. Sundar Pichai, Alphabet’s CEO, recently said,

“We are seeing our AI investments and infrastructure drive revenue and growth across the board. We’ve been supply-constrained, even as we’ve been ramping up our capacity. Obviously, our capex spend this year is an eye towards the future.”

Investors, on the other hand, are skeptical of the investments, questioning whether they will deliver profits fast enough to back up current valuations.

Weak job reports are also adding to the pressure, with rising unemployment claims and job openings at a 5-year low, according to the Wall Street Journal. Layoffs are further fuelling sentiment, with tech layoffs in 2026 climbing to 24,818, according to Layoffs.fyi.

The Future Remains Uncertain

Despite the early Friday gains that seem to be bringing the market on track, things remain volatile. Investors are keenly looking at corporate profits, which could increase confidence. Higher layoffs and fewer job openings, on the other hand, can take it further down.

Also Read: Bitcoin vs Gold: JPMorgan Turns Bullish as BlackRock Sells $175M

Beyond equities, other markets have also experienced volatility in the recent past. One of the most valued crypto assets, Bitcoin, has fallen sharply, 29.28% in the past month.

Experts caution against reading too much into the Dow Jones futures’ Friday recovery, citing that a sustained rebound will depend on how quickly investor confidence returns.