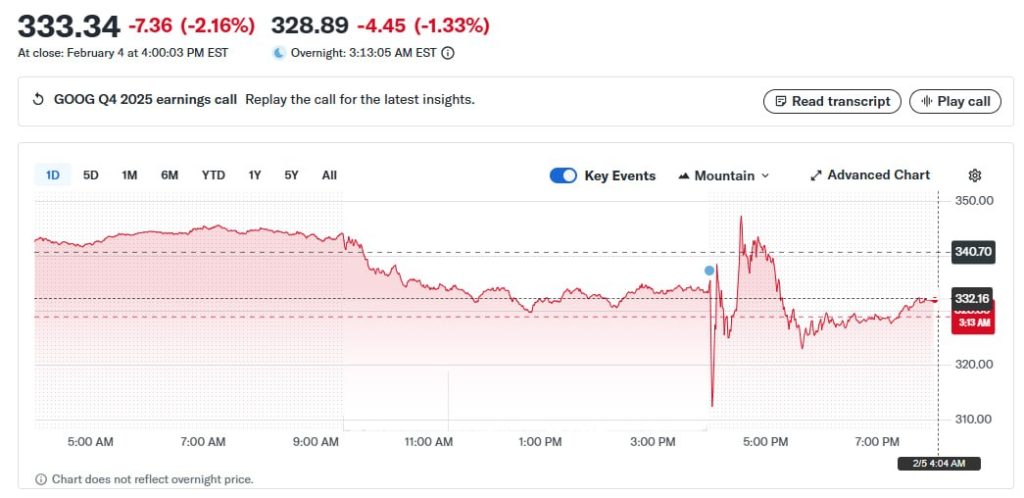

GOOG stock stumbled in extended trading Wednesday evening despite the tech giant crushing Wall Street’s fourth-quarter expectations, as investors digested Alphabet’s eye-popping $175 billion to $185 billion capital expenditure forecast for 2026. Alphabet (GOOG) stock price initially jumped after the earnings release but ultimately slipped 0.5% in after-hours trading, revealing Wall Street’s growing sensitivity toward massive AI infrastructure spending even when fundamental results exceed expectations.

The company reported adjusted earnings of $2.82 per share on revenue of $113.82 billion for the October-December period, beating analyst estimates by $0.18 and $2.34 billion respectively. Net income surged 30% year-over-year to $34.46 billion, and also revenue climbed 18%. Alphabet also crossed $400 billion in annual revenue for the first time in its history, as Google executives shared on the earnings call.

Google Stock Faces Volatility Despite Gemini AI And Earnings Call Gains

Cloud Business Outpaces Microsoft’s Azure

Google Cloud emerged as a standout performer on the Google earnings call, with revenue jumping 47.7% year-over-year to $17.7 billion and handily surpassing the 35% growth expectations. This figure also outpaced Microsoft’s Azure, which posted 34% growth for the same period last week. The cloud unit’s backlog was reported to have surged 55% sequentially and more than doubled year-over-year, reaching $240 billion at the end of the fourth quarter.

CEO Sundar Pichai told analysts during the call, “We’re seeing our AI investments and infrastructure drive revenue and growth across the board… Search saw more usage than ever before, with AI continuing to drive an expansionary moment.“

Search revenue grew 17% to $63.01 billion, and YouTube sales rose 9% to $11.38 billion. The company’s broader Services segment saw revenues increase 14% to $95.5 billion, though the Google Ad Network experienced a 2% decline.

Capex Forecast Rattles Nasdaq Tech Stocks

The projected 2026 capital expenditure represents more than double what Alphabet spent in 2025, which was around $119.5 billion. At the midpoint of $180 billion, the spending would exceed what the company invested over the previous three years combined. This announcement came at a time when Nasdaq tech stocks have shown particular sensitivity to AI-related spending, with the software sector losing 30% of its value over the past three months.

CFO Anat Ashkenazi explained that the capex will be directed toward AI compute capacity for Google DeepMind and to meet significant cloud customer demand as well as strategic investments in other bets. She also noted that the vast majority of Alphabet’s capex was invested in technical infrastructure with approximately 60% of that investment in servers and 40% in data centers and networking equipment in Q4.

Right now, investor reaction to Google stock reflects broader concerns about whether these massive investments will translate into proportional returns, even as the underlying business fundamentals remain strong. Alphabet stock price has mirrored similar dynamics across other major tech companies announcing elevated capex plans, with Google stock trading patterns following broader market sentiment.

Gemini AI Momentum Builds User Base

The company’s flagship Gemini AI app now boasts 750 million monthly active users, up from 650 million in the previous quarter. The November launch of Gemini 3 marked what analysts at CFRA Research called a major milestone in Alphabet’s AI strategy. At the time of writing, this user growth provides concrete evidence that the company’s AI product strategy is succeeding and helps justify the massive infrastructure investments the company is making.

Pichai also highlighted the company’s partnership with Apple to overhaul the Siri virtual assistant using Gemini AI models, reiterating that Apple had chosen Google as its preferred cloud provider for the project. This strategic partnership could provide additional support for Google stock as the AI ecosystem expands.

When asked what concerns him most, Pichai responded with a single phrase: “compute capacity.” He elaborated, “Be it power, land, supply chain constraints, how do you ramp up to meet this extraordinary demand for this moment?“

Market Sentiment Remains Mixed

Open interest in GOOG stock call options for the March expiration has jumped over 20% in overnight trading, signaling that some traders are building bullish positions despite the after-hours decline. On Stocktwits, retail sentiment for Google stock shifted to “extremely bullish” from “bullish” amid “extremely high” message volume.

Amin Vahdat, Google’s AI infrastructure boss, previously told employees that the company must double its serving capacity every six months to meet demand for AI services. He said, “The competition in AI infrastructure is the most critical and also the most expensive part of the AI race.“

The company’s December acquisition of data center company Intersect for $4.75 billion in cash and assumed debt underscores its commitment to rapidly expanding infrastructure capacity. The company saw this move as necessary to address the compute capacity concerns raised on the Google earnings call.

While the initial market response to Google stock was tempered by the capex forecast, analysts suggest that the strong fundamental performance across search, cloud, and advertising could provide support for Google stock in coming weeks. Investors are weighing the long-term AI growth opportunity against near-term margin pressures, and the trajectory of Nasdaq tech stocks more broadly will likely influence sentiment around Alphabet’s shares.