Despite financial analysts predicting he will become the world’s first trillionaire, Elon Musk’s cash holdings remain surprisingly thin. In a world where liquid capital is king, the world’s richest individual is playing by an entirely different set of rules. The Tesla CEO’s wealth is reportedly less than $850 million in liquid cash. While that figure sounds astronomical to the average saver, it represents less than 0.1% of his total empire.

Also Read: Precious Metals Price Prediction: Gold Could Hit $7K-$8K by May 2026

Tesla CEO Holds Less Than 0.1% of Net Worth in Cash

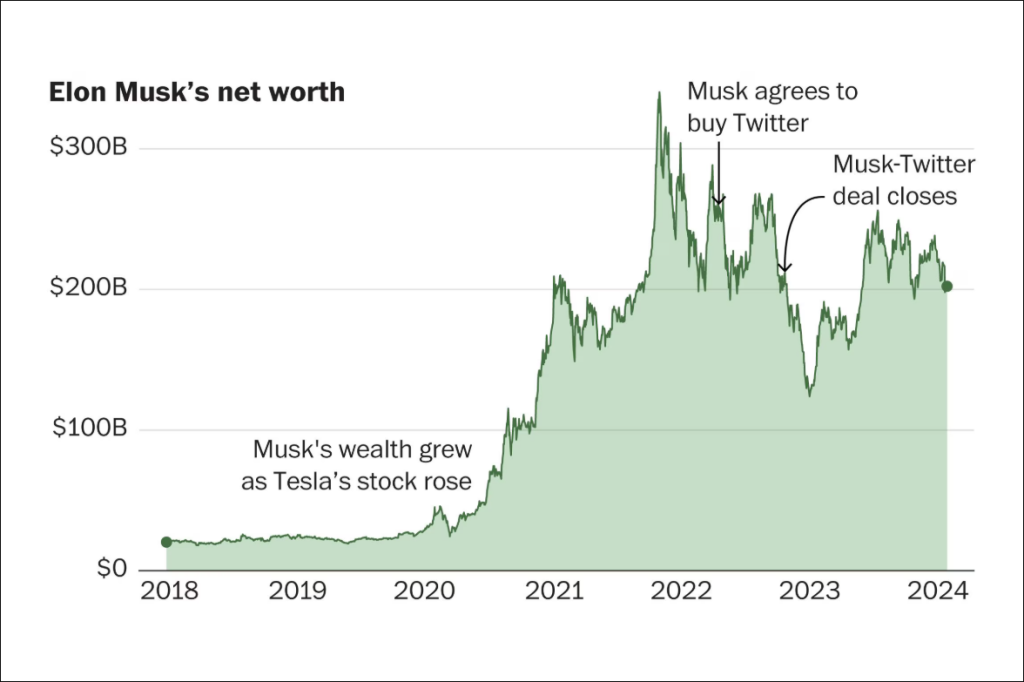

There’s an obvious stark disparity between Elon Musk’s net worth and his bank balance. However, it is all by design. While his net worth has recently surpassed the $800 billion mark, the vast majority of his wealth is tied up in illiquid Elon Musk assets. He believes in an all-investment philosophy, so a large chunk of his wealth is in his massive equity stakes in Tesla, SpaceX, and X (formerly Twitter).

So why does he tend to accumulate wealth through stock appreciation and ownership, not cash savings? Going equity-heavy allows Elon Musk to maximize long-term growth. Rising company valuations can multiply his net worth far faster than holding liquid money, hence why he keeps it less than 0.1% of his total wealth. It also preserves influence and control over his ventures, while enabling him to borrow against shares when liquidity is needed.

Also Read: Morgan Stanley Hires Blockchain Engineers for Multi-Chain Integration

Elon Musk’s Money Timeline

If you follow the Tesla’s CEO wealth roadmap, you’ll notice a consistent pattern. He almost always avoids idle capital. For instance, his first venture, Zip2, after co-founding it with his brother, was later sold to develop X.com.

X.com steered him into merging with another banking company, which ended up as PayPal. After it was sold, he used this money and founded SpaceX. And when SpaceX needed him, he pumped in money to stop them from going bankrupt.

Also Read: $500M UAE Investment in Trump’s World Liberty Financial Triggers Probe

Elon Musk’s money timeline is clear: liquid cash is a liability in a high-innovation economy. Analysts point out that by avoiding stagnant money, Musk ensure’s his capital is always circulating in the highest-growth sectors. His preference for equity over currency seems to have paid off. This has fueled speculation that he could become the world’s first trillionaire.