Gold’s price surge crossed the $5,000 mark on February 19, 2026, with Gold Futures sitting at $5,010.91 at the time of writing. The move is being driven by a mix of safe haven demand, geopolitical risk tied to Trump Iran tensions, and a dollar that has lost over 8% of its value year-on-year. Gold 5000 is no longer just a talking point, but where the market is right now.

Also Read: UAE Bitcoin Mining Hits 6,782 BTC as $344M Profit Builds National Stockpile

How the Gold Price Surge and Geopolitical Risk Collide at $5,000

A Military Buildup Markets Can’t Ignore

The gold price surge is being fueled, at least in part, by what CNN reported on February 19, 2026:

CNN reported, citing sources familiar with the matter:

“The US is prepared to strike Iran as early as this weekend, but Trump has yet to make a final call.”

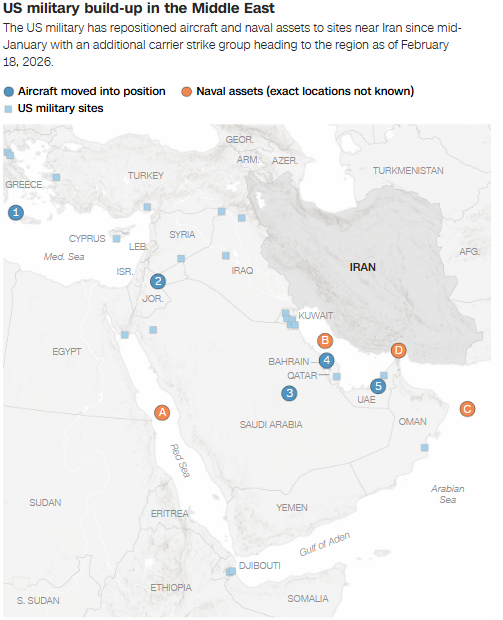

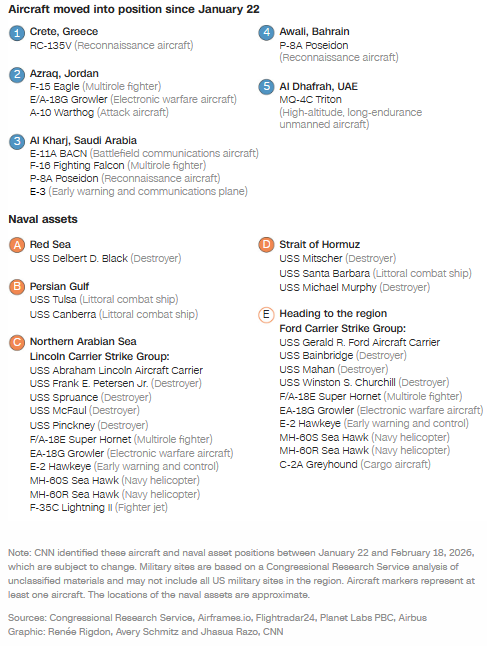

US military assets have been repositioned near Iran since mid-January, and an additional carrier strike group was heading to the region as of February 18. Aircraft including F-15 Eagles, A-10 Warthogs, and F-16s were moved into Jordan and Saudi Arabia. Naval assets, among them the USS Abraham Lincoln Carrier Strike Group, are already positioned in the Northern Arabian Sea.

Safe haven demand tends to spike when conflict risk is this concrete, and gold 5000 is where that fear is being priced in.

Also Read: BRICS Digital Currency Accelerates De‑Dollarization and Shakes USD Dominance

The Dollar and Inflation Picture

The US Dollar Index is sitting at 97.595, down 8.84% over the past year. A weaker dollar adds direct pressure to the gold price surge since international buyers get more exposure for less. The geopolitical risk environment is doing the rest.

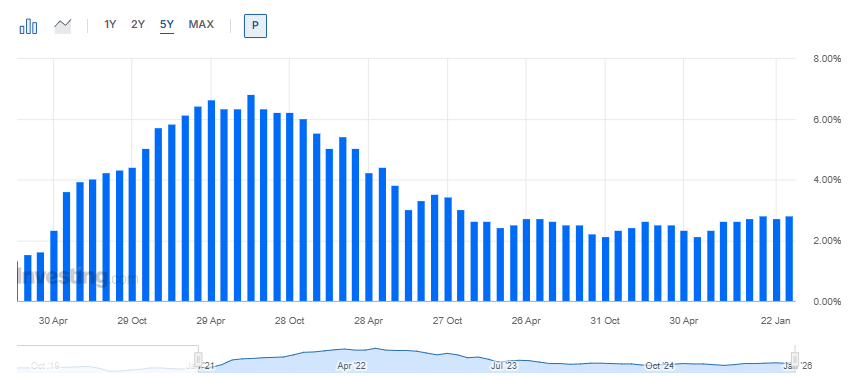

Inflation has cooled significantly since its 2022 peak, but PCE is still sitting above the Fed’s 2% target at around 2.5%. That keeps rate cuts off the table for now, and gold 5000 continues to hold as a result. As long as Trump Iran tensions remain unresolved and safe haven demand stays elevated, the gold price surge isn’t showing signs of slowing.

Also Read: Fed’s $18.5B Repo Injection Tops Dot-Com Levels and Redefines ‘Normal’