A new AAVE ETF filing was placed by Grayscale Investments to convert its existing AAVE Trust into a spot AAVE ETF. The proposal is in line with the firm’s strategy of transforming closed-end crypto trusts into exchange-traded products, expanding investor access to digital assets through traditional brokerage channels.

Also Read: Is Trump Pushing the World Toward China and Global De-Dollarization?

How the Aave ETF Filing Shapes Grayscale, Bitwise, and AAVE Price Trends

The paperwork submitted to the U.S. Securities and Exchange Commission would list AAVE on NYSE Arca if approved. The filing arrives shortly after rival asset manager Bitwise previously sought approval for crypto ETFs covering multiple tokens. Now with AAVE joining the chat, it intensifies the competition in the emerging altcoin ETF segment.

Still, since Bitwise was first to file, it predates Grayscale’s move. This means the race could hinge on regulatory timing and exchange readiness. After all, first-to-market ETF issuers often capture the majority of early inflows, making speed critical in securing investor mindshare and liquidity.

Also Read: Costco Returns Crackdown: Is COST Stock Protecting Margins?

Asset managers are increasingly targeting DeFi infrastructure tokens rather than just layer-1 blockchains like Bitcoin (BTC) and Ethereum (ETH). This, in turn, lets investors know that DeFi protocols are core financial infrastructure and opens the door to massive liquidity. And with AAVE holding the largest DeFi protocol with over $27 billion total value, the stakes for this ETF race couldn’t be higher.

According to market analysts, the rivalry between the Grayscale AAVE ETF and Bitwise’s offering is driving a massive wave of institutional interest.

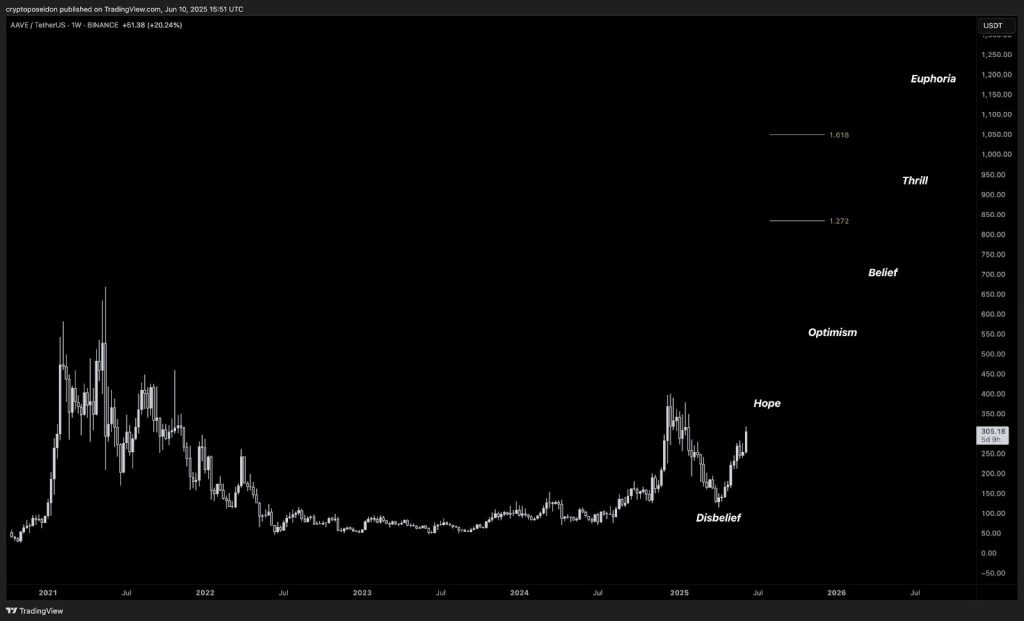

From the chart below, the AAVE price saw a significant uptick after the filing.

Strategic Rivalry

Grayscale has proposed a 2.5% sponsor fee, which is notably higher than those seen in the spot Bitcoin ETF wars. However, Grayscale aims to differentiate itself through its direct token-holding model and a robust partnership with Coinbase, which will serve as both custodian and prime broker.

Also Read: SoundHound AI Stock: Is Agentic AI the Real Catalyst in 2026?

Conversely, Bitwise is yet to disclose its fee structure. However, from its fee history with other crypto ETF products (like Bitcoin or Ethereum strategies), Bitwise generally aims for much lower fees, often below 1% in its ETF structures to stay competitive. Regardless of either high or low fees, it signals we’re headed to a healthy, mature market.