Dollar dominance is under pressure, and the IMF has made that clear. The fund has warned that China’s industrial subsidies are generating a level of export overcapacity so large it’s distorting global trade imbalance across multiple continents. State-backed overproduction in sectors like EVs, steel, and solar is being pushed into global markets at prices no competitor can match, and the consequences for the dollar’s role in global trade are starting to show.

Also Read: SHIB Price Prediction 2026: What $1,000 in SHIB Could Be Worth at ATH

How China’s Industrial Subsidies Are Shifting Global Dollar Dominance

Europe Is Already Feeling It

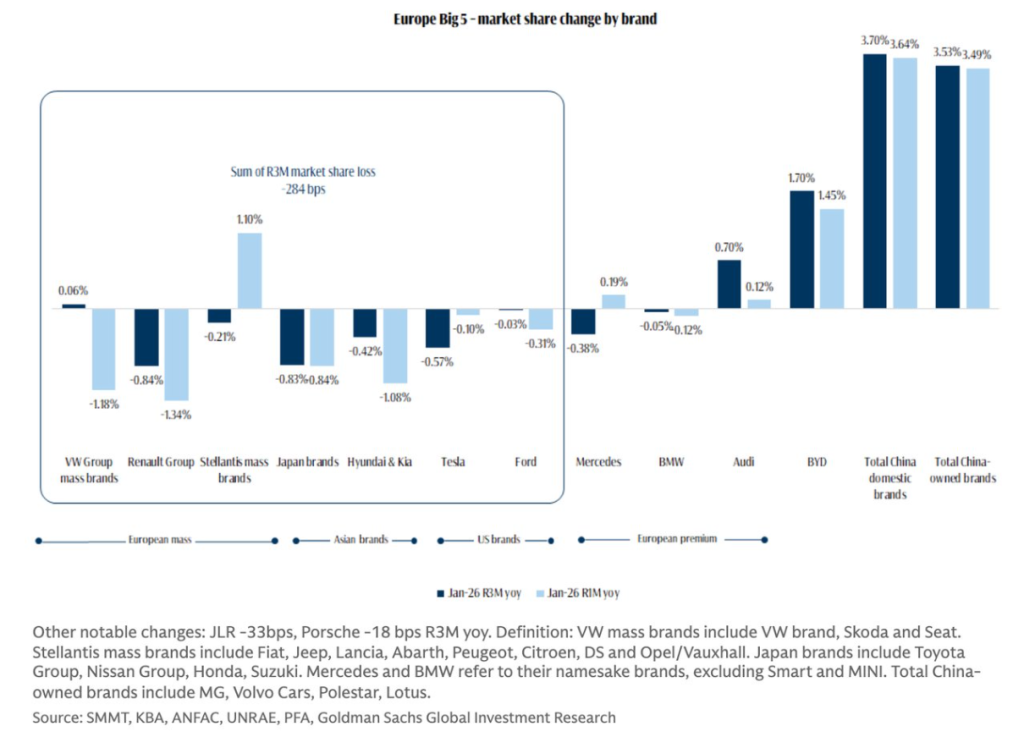

The European auto market is one of the clearest examples of what China’s export overcapacity actually looks like in practice. Data from Goldman Sachs Global Investment Research shows China-owned brands gaining market share while VW, Renault, and Stellantis are all losing ground.

Zerohedge stated:

“China has absolutely killed the European auto market.”

Also Read: Nvidia Nears $30B OpenAI Investment After $100B Funding Deal Stalls

The Factory That Makes It Real

BYD is currently building a mega factory larger than San Francisco. Commentator Chay Bowes had this to say:

“At this scale, and such low costs, vast human resources, and its own market, it will become impossible for Europe to compete.”

That kind of industrial capacity, backed by China’s industrial subsidies, is exactly what the IMF’s warning is pointing at.

What It Means for Dollar Dominance

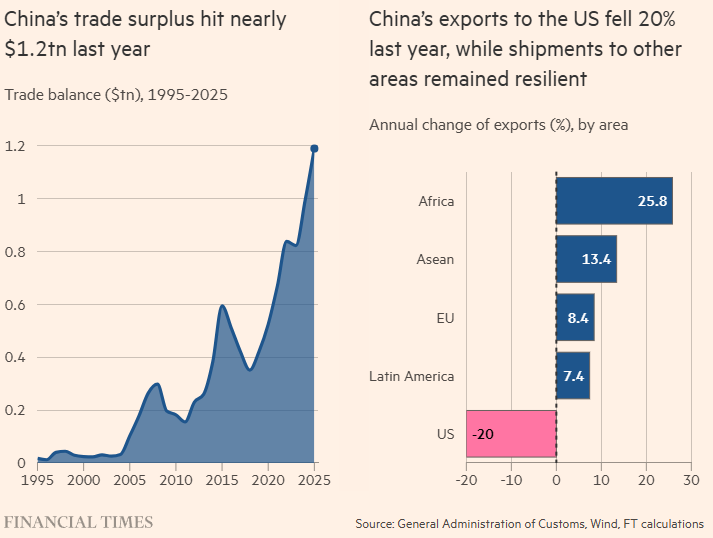

China’s trade surplus hit nearly $1.2 trillion last year, and the direction of those exports tells the real story. Shipments to the US fell 20%, while Africa saw a 25.8% increase, ASEAN 13.4%, and the EU 8.4%. That is not a coincidence. It is a deliberate rerouting of export overcapacity toward regions where dollar dominance is already thinner on the ground.

As China’s export overcapacity pushes trade agreements that bypass dollar-denominated systems, the global trade imbalance grows harder to ignore.

Countries receiving Chinese goods at subsidized prices are increasingly settling trade in yuan or through China-linked arrangements, slowly chipping away at dollar dominance in ways that don’t make headlines but add up over time. The IMF warning makes clear this is no longer a fringe concern.

Also Read: White House Sets March 1 Deadline in Stablecoin Rewards Dispute as XRP, Coinbase Attend