U.S. President Donald Trump has been pushing policies aimed at boosting the dollar and diminishing any de-dollarization efforts. But it seems to be taking a whole different turn as a broader U.S.-China geopolitical shift is now coming into play. This, however, isn’t limited to a policy change or announcement. Instead, a rather quiet shift is coming into existence, and it is showing up in the numbers.

Also Read: Costco Returns Crackdown: Is COST Stock Protecting Margins?

How Trump’s De-Dollarization and US-China Shift Reshape Global Power

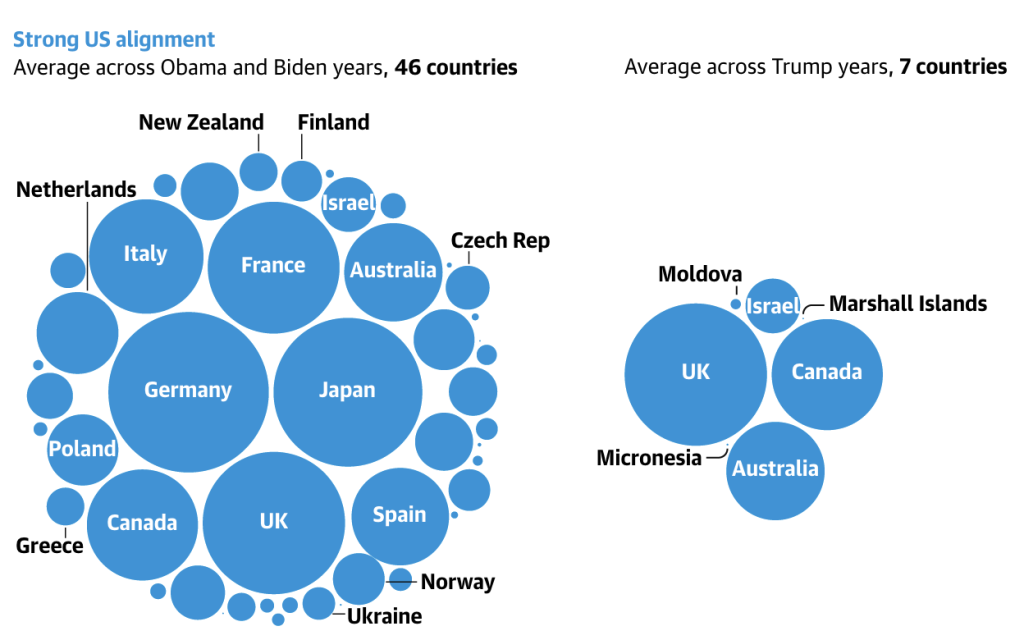

At the United Nations, countries that once voted consistently alongside the U.S. are no longer doing so. A recent analysis found that in 2024, 46 countries were closely aligned with the U.S. on key votes. Fast forward to 2026, and that number has now dropped to just seven.

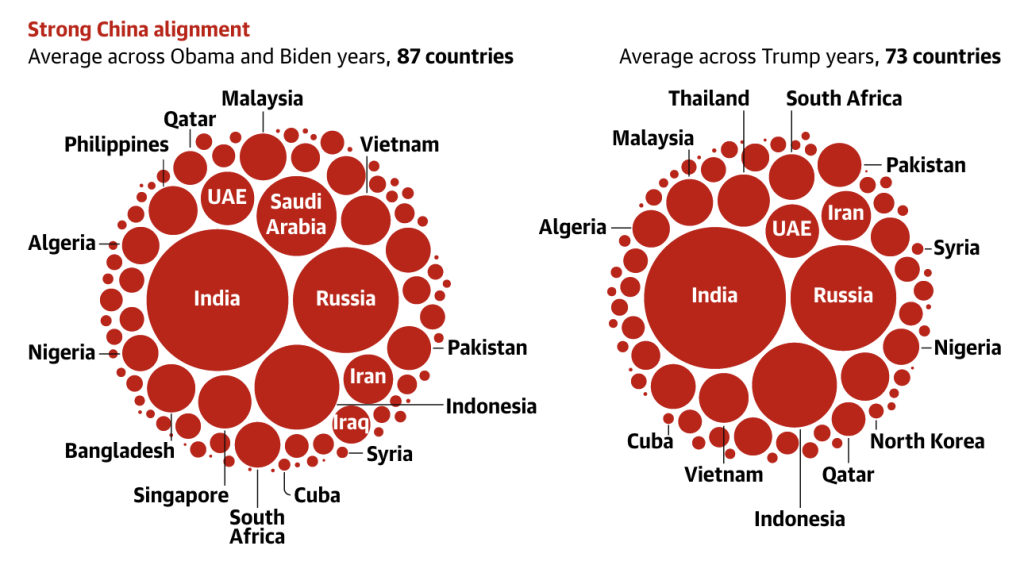

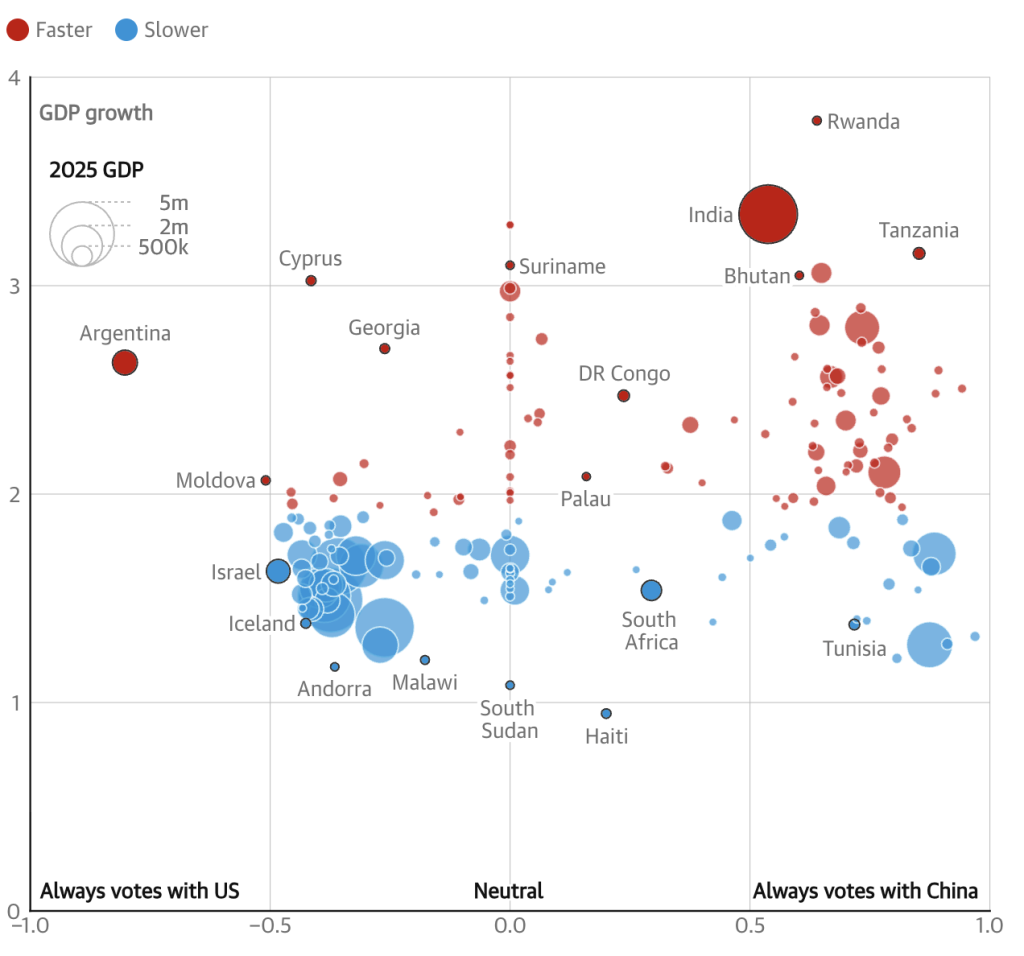

China’s bloc, in contrast, has remained far more stable. Many of the countries maintaining alignment with Beijing are also among the fastest-growing economies. This further reflects China’s rising influence across the globe.

As seen in the above chart, traditional allies were clearly steering away. Research shows that in 2025, nations like Canada, Germany, Japan, South Korea, and the UK voted with the U.S. less frequently. This shows how Trump’s foreign policies have impacted the globe, as even long-standing partners are diplomatically abandoning the U.S.

In addition, Trump’s administration has leaned heavily on tariffs and has taken a more transactional approach to alliances. Alongside this, several viral posts, including a widely shared Binance Square update, claimed Trump threatened 1,000% tariffs in response to China and Russia weakening the dollar. But no reputable or official sources have confirmed such a policy.

A CNBC report highlights how the global economic system is now experiencing a “rupture.” Analysts believe that countries have begun to rethink long-term economic dependence on the Trump-led country.

Europe is reportedly among those adjusting. According to the BBC, governments have been increasingly discussing strategic autonomy. This is particularly in trade and defence. The BBC wrote,

“European powers see in Trump a truly transactional president who thinks nothing of leveraging security or economic relations with his closest allies to get what he wants. Just before being re-elected president, for example, he told Europeans that the US would not protect nations that didn’t pay their way on defence.“

Also Read: SoundHound AI Stock: Is Agentic AI the Real Catalyst in 2026?

A Look Into China’s Rising Influence

At the same time, China seems to be gaining popularity through trade and expansion. Across Asia, Africa, and Latin America, China has emerged as the largest trading partner for many countries. These geopolitical shifts are feeding into the global de-dollarization trend. The dollar remains dominant, but more countries are increasingly using alternative currencies. This includes China’s yuan for trade settlement.

A report from Focaldata reveals that faster-growing economies are now siding more with China. Data journalist Patrick Flynn said,

“With China’s outsized influence among the fastest-growing economies, the global centre of gravity could well move into Chinese territory for the first time in the late 2030s.”

Politico has reported that global leaders are watching the evolving relationshop between Trump and Chinese President Xi Jinping closely, as changes in that dynamic could accelerate broader realignment. But Trump should be wary about how influence is spreading, alliances are shifting and the global system is gradually becoming less centered on a single power.

Also Read: X Set To Launch Crypto And Stock Trading With Smart Cashtags