Intesa Sanpaolo has quietly stepped into Bitcoin (BTC). The Italian banking group disclosed a $100 million position tied to a Spot Bitcoin ETF. This marks one of the clearest signs yet that major European banks are gaining exposure to crypto. The position appeared through institutional investment filings, placing Intesa among a small but growing group of traditional banks participating in Bitcoin through regulated products.

The Intesa Sanpaolo Bitcoin moves carry weight. The bank oversees more than $925 billion in total assets, according to its official financial reports. Its decisions tend to reflect long-term strategy, not short-term market moves.

Also Read: Apple Stock Forecast: AI Smart Glasses Spark New AAPL Price Targets

Why Intesa’s Bitcoin ETF Position Signals Rising Institutional Adoption

Bitcoin ETFs have changed how institutions approach crypto. Instead of managing wallets or custody, banks can buy ETF shares like any other financial instrument. The structure reduces operational risk and fits existing compliance systems. That has made Bitcoin ETF investment easier to justify internally.

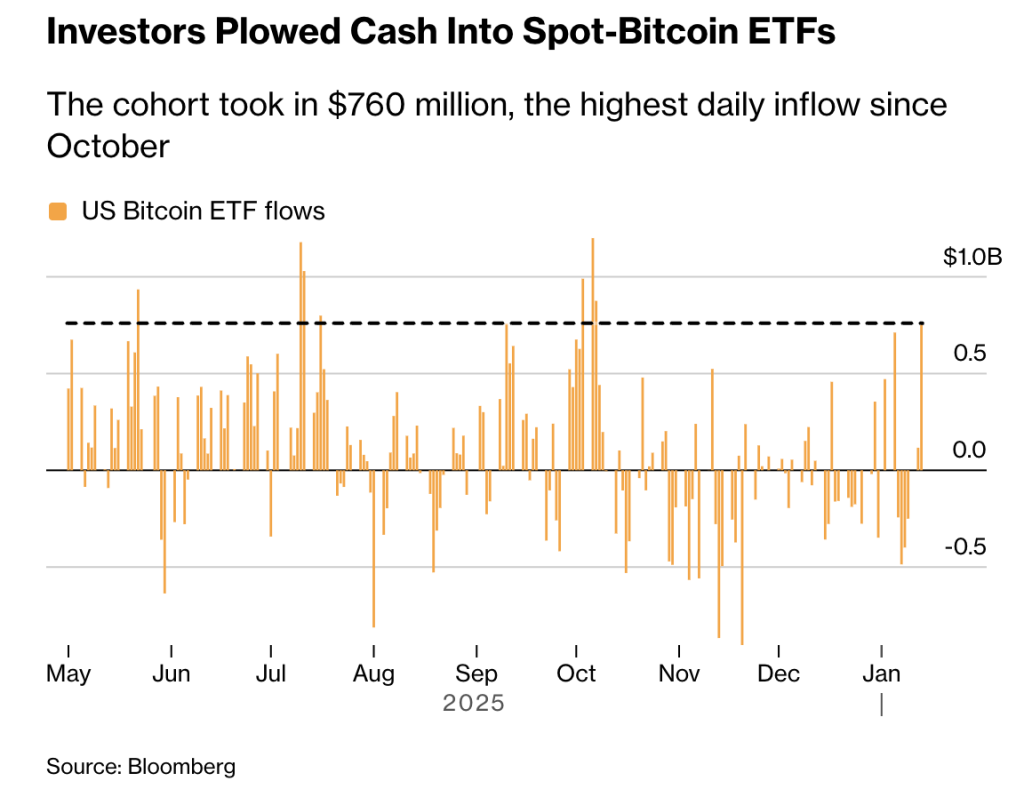

Data from Bloomberg shows these funds have attracted tens of billions in inflows within their first year. The demand has come mostly from institutions, not retail investors.

Intesa’s position reflects this shift. European banks have been slower to enter the market compared to U.S. asset managers. That gap now appears to be narrowing. Exposure through a Spot Bitcoin ETF allows banks to participate without directly holding Bitcoin.

Also Read: Shiba Inu Rolls Out ‘Shib Owes You’ NFT to Restore Trust

This trend is part of a broader wave of institutional crypto adoption. Large financial firms are no longer watching from a distance. They are allocating capital, even if cautiously.

Bitcoin’s size also makes it harder to ignore. Its total market value remains above $1 trillion, according to CoinMarketCap. That scale has helped push Bitcoin into conversations inside traditional finance. The world’s largest cryptocurrency was trading at $68,072.01 following a 2.08% rise throughout the past week.

For Intesa Sanpaolo, the move is measured. It does not represent a major shift in its balance sheet. But it signals changing attitudes. This kind of BTC investment news rarely arrives with fanfare. It shows up quietly, in filings and disclosures. Over time, those small entries add up.

Also Read: Ethereum RWA Market Surges 315% as Tokenized Assets Break $17 Billion