Meta stock price faces a downside risk of around 10% to 15%, according to Needham analyst Laura Martin. She recently cautioned that the shares may be overvalued given the massive spending commitments ahead. At $667.62 on February 5, 2026, the Meta stock price today reflects growing investor concerns about the company’s capital spending plans that could end up pressuring margins even as Wall Street’s Meta stock price prediction remains bullish among most analysts.

Meta Stock Price Today With Analysis, Prediction & Target Insights

Analyst Warning On Valuation

Needham senior analyst Laura Martin issued a cautionary Meta stock analysis in early February, and her concerns center on what she describes as an unforgiving valuation environment. In a recent interview, Martin said Meta Platforms is “priced for perfection” but could decline 10% to 15% if growth targets are not met. Her focus is less on Meta’s competitive position and more on the timing risks that the company faces right now.

Needham’s analysis estimates that operating margins may compress from around 40% in 2025 to the low 30% range in 2026. This represents a significant reset for such a premium-valued stock, and the concern is particularly acute because much of Meta’s expense is difficult to reverse in the near term. Martin also believes that capital expenditure cycles have historically implied a higher downside risk, especially as returns on invested capital decline.

AI Acceleration Drives Momentum

CEO Mark Zuckerberg remains optimistic about Meta stock price prediction despite the heavy spending cycle that’s underway. During the Q4 earnings call, Zuckerberg stated:

“We are now seeing a major AI acceleration. I expect 2026 to be a year where this wave accelerates even further on several fronts.”

Meta reported fourth-quarter revenue of $59.89 billion, which jumped 24% year-over-year and beat analyst estimates of around $58.5 billion. Earnings per share came in at $8.88, which also exceeded expectations. The company’s ad impressions climbed 18% during the quarter, while the average price per ad rose 6%. Daily active users across Meta’s platforms grew 7% year-over-year to reach 3.58 billion.

However, the company now projects capital expenditures at somewhere between $115 billion and $135 billion for 2026, which is nearly double the $72.2 billion spent in 2025. Meta is directing this spending primarily toward AI infrastructure and also technical talent for Meta Superintelligence Labs. The company expects total expenses for 2026 to range from $162 billion to $169 billion, up significantly from about $118 billion in 2025.

Meta stock price has given back all of its post-earnings gains from late January, with shares falling roughly 10% from the January 29 closing price. This decline occurred as the broader tech-heavy Nasdaq Composite also pulled back about 3.5% during the same period. The stock’s 52-week range of $479.80 to $796.25 reflects both the strong earnings momentum and the volatility associated with AI investing cycles right now.

Wall Street’s Mixed Views

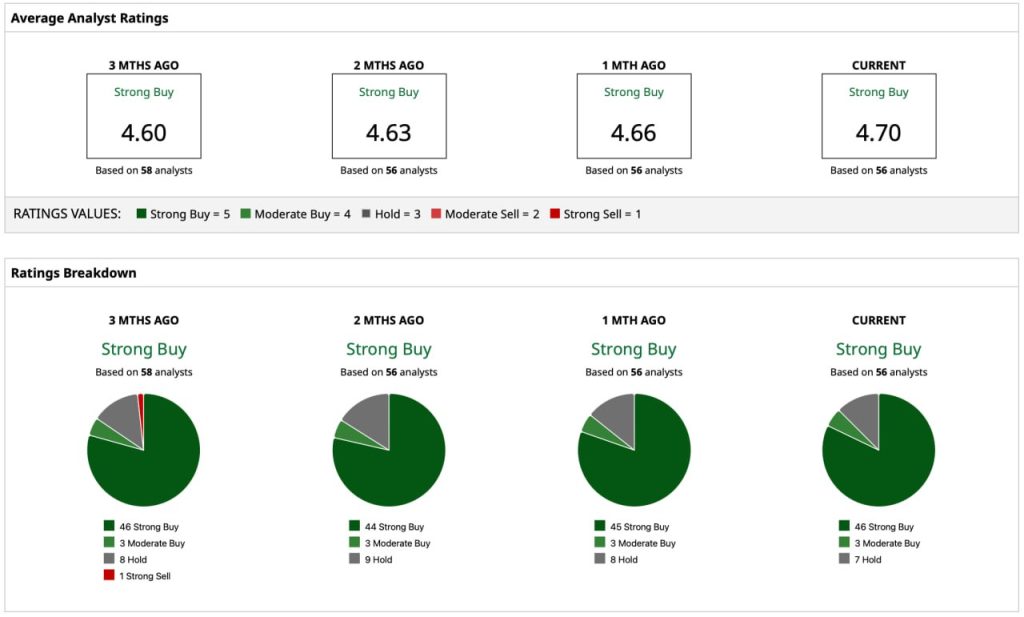

The consensus Meta stock price target among 56 analysts sits at $859.31, and this suggests around 24.2% upside from current levels. The Meta stock analysis shows targets that range from Scotiabank’s conservative $700 all the way up to Rosenblatt Securities’ bullish $1,144. With the price today trading well below these targets, some analysts see an opportunity. The Meta stock maintains a “Strong Buy” rating based on 56 Buy recommendations, though a small number of Hold and Sell ratings reflect varied perspectives on the company’s near-term outlook.

Recent analyst actions have been generally positive, with Jefferies Financial Group raising its Meta stock price target to $1,000 on January 29, and Evercore ISI lifting its outlook to $900. Morgan Stanley also raised its target to $825 around the same time. Despite this optimism, Meta stock price volatility remains high as investors continue to weigh AI-driven growth potential against unprecedented infrastructure spending that could constrain near-term profitability and margins.