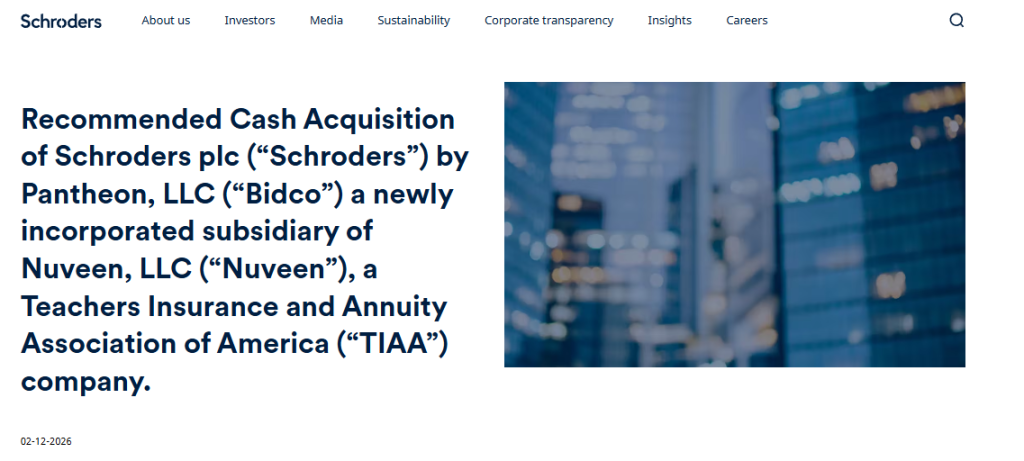

Nuveen’s Schroders acquisition has been finalized in a deal valued at £9.9 billion, or approximately $13.5 billion, creating a global asset management powerhouse. The Nuveen deal will elevate the combined firm into the top tier of active money managers worldwide, overseeing total assets of around $2.5 trillion. This Schroders sale drives major consolidation in the financial services sector, and regulators must approve the asset management merger before it can close under standard conditions.

Also Read: Richard Teng Backs Hong Kong’s Push to Become a Global Crypto Hub

How the Nuveen Schroders Acquisition Redefines the Asset Management Merger Space

Deal Structure and Market Impact

The Nuveen Schroders acquisition agreement was reached recently, with the transaction set to significantly expand Nuveen’s market position and asset management capabilities. Right now, this $13.5B acquisition stands as one of the largest deals in the sector, and it reflects the ongoing consolidation trend as firms seek to bolster their competitive edge through strategic mergers.

The Nuveen deal will create a combined organization managing $2.5 trillion in assets, positioning it among the elite global active managers. This scale provides enhanced investment research capabilities, operational efficiencies, and also broader product offerings across multiple markets. The Schroders sale enables both firms to compete more effectively against passive investment strategies and fee compression pressures.

Also Read: Meta Unveils $10B Indiana AI Data Center With 1GW Infrastructure Expansion

Regulatory Timeline and Integration

The asset management merger must clear regulatory hurdles in multiple jurisdictions before completion. At the time of writing, the transaction awaits approvals from financial regulators, which typically require several months for deals of this magnitude. The customary closing conditions include antitrust reviews and shareholder approvals.

Strategic Consolidation in Financial Services

This $13.5B acquisition underscores how traditional asset managers are adapting to market pressures. The Nuveen Schroders acquisition provides both firms with the scale needed to invest in technology, talent, and sustainable investment strategies. Larger platforms can better absorb regulatory costs and navigate complex global markets.

Also Read: Strategy CEO Phong Le Plans to Issue More Perpetual Preferred Shares

The combined entity’s success will depend on effective integration and delivering value to institutional and retail clients. Industry observers view this Nuveen deal as a potential template for future consolidation activity, particularly as asset managers evaluate strategic options in an increasingly competitive environment. The Schroders sale and subsequent merger could reshape how firms approach growth and market positioning in the years ahead.