Prominent trading platform Robinhood recorded a major drop in stock price shortly after the company released its Q4 earnings. The HOOD stock plummeted by over 7% on February 10, in after-hours trading. The decline followed a challenging Q4 2025, as Bitcoin (BTC) and a slew of other assets noted steep declines.

Also Read: Vatican Launches Catholic Equity Indexes With Morningstar as Tokenized Assets Surge

Robinhood Earnings Slow Growth as Investors Reassess HOOD Outlook

Robinhood delivered mixed Q4 results. The firm experienced solid annual growth, albeit with a modest revenue miss. During the final quarter of 2025, the trading giant generated $1.28 billion in revenue. This marked a 27% rise from the previous year. But the figure fell short of analysts’ expectations of $1.34 billion. The decline was seen impacting the HOOD stock price.

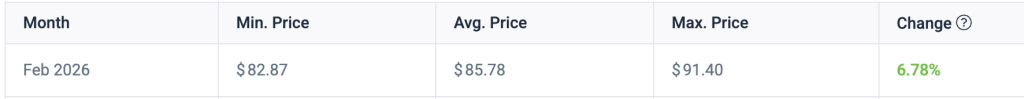

Robinhood’s stock chart shed more light on the massive decline. At press time, HOOD stock price stood at $85.60.

Elaborating on the current state of Robinhood’s stock price, Christian Bolou, an analyst at Autonomous Research, told Yahoo Finance:

“A top-line miss is not helpful at all.The stock reaction might be warranted here, given high expectations and a very expensive stock.”

Profitability wasn’t far behind. Robinhood’s growth was witnessed through its net income, which stood at $605 million for the quarter. Earnings per HOOD surged to $0.66, topping estimates of $0.63. In addition, for the entire year, the firm recorded $4.5 billion in revenue. This reflected a 52% increase compared to the year before.

Also Read: Backpack Token Nears Unicorn Status After $50M FTX-Linked Raise

HOOD Stock Price Prediction: Will February Bring In More Gains?

According to recent data from CoinCodex, HOOD stock is expected to have a fairly good month of February. Despite its recent decline, the asset has the potential to reach $91.40 per stock. The average trading price of HOOD was positioned at $85.78.

In a parallel push to boost its crypto footprint, Robinhood launched a public testnet for Robinhood Chain. This Ethereum-based layer-2 network operating on Arbitrum is expected to witness a bigger rollout later in 2026.

The latest blockchain is focused on powering round-the-clock trading and enabling self-custody of tokenized stocks, ETFs, and other real-world assets. The brokerage is collaborating with Chainlink and employing the network’s oracle platform for Robinhood Chain.

Also Read: Robinhood Chain Launches Ethereum Layer 2 for Tokenized Real‑World Assets