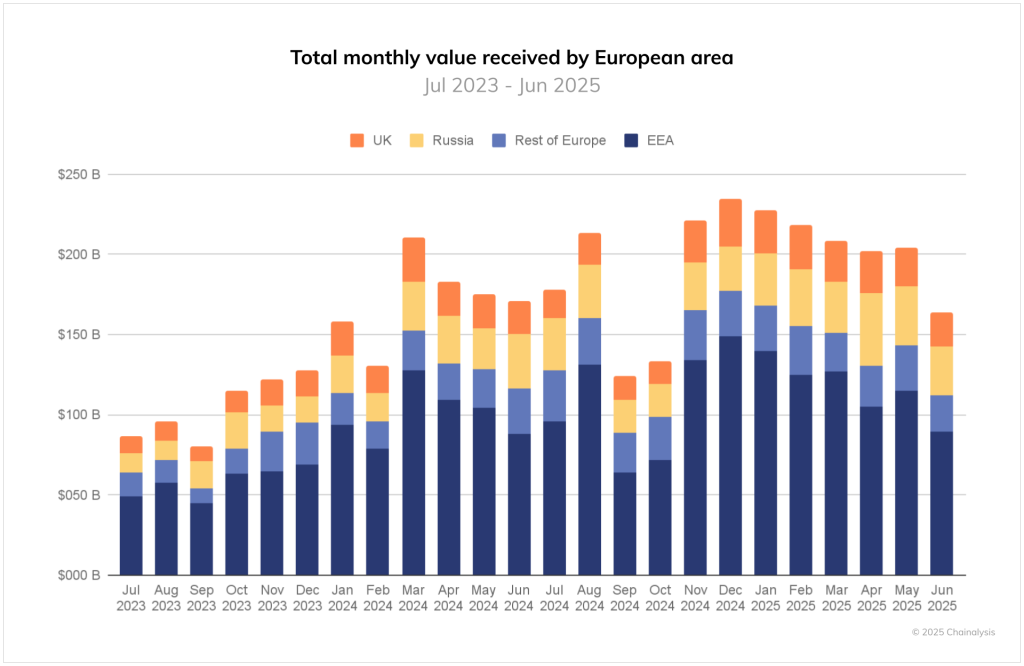

Russia’s crypto market is no longer operating on the sidelines. But Europe seems to be trying to cut off its access just as quickly. Blockchain analytics data shows a notable rise in activity tied to Russian users, with about $648 million flowing into crypto channels. This highlights the scale of the current Russia crypto surge. The latest shift highlights a notable change in how money moves in and out of the country.

Also Read: 3 Space Defense Stocks to Buy After NASA’s Asteroid 2026 Warning

How Russia’s Crypto Surge Collides With EU Sanctions and Regulations

According to data from Chainalysis, the country recorded $376.3 billion in crypto inflows between July 2024 and June 2025. With this, Russia surpassed the United Kingdom’s outflows of $273.2 billion during the same period. Sergey Shvetsov, Chairman of the Moscow Exchange’s Supervisory Board, said Russian investors are estimated to pay around $15 billion each year in commissions to international crypto exchanges.

Russian crypto trading has primarily expanded due to sanctions pressure. The cryptocurrency market is now offering Russians something traditional finance cannot easily provide, which is flexibility. Transactions are carried out without relying on institutions that could be blocked or restricted.

But several European officials are viewing this flexibility as a risk. According to a recent report, the European Commission is preparing a rather stringent set of crypto restrictions. The proposal would ban EU individuals and companies from dealing with any crypto service provider established in Russia.

Also Read: Metaplanet’s Bitcoin Holdings Rocket to 35,102 BTC as Losses Hit $619M

The new plan goes further than the earlier sanctions imposed on Russia. Instead of targeting individuals exhcanges or wallets, it would block all Russian-linked crypto transactions. Officials say cryptocurrencies, stablecoins, and blockchain-based payment systems have created alternative routes for moving money outside traditional oversight. The latest EU crypto sanctions aim to close these gaps.

This proposal, however, needs approval from all 27 EU member states. Therefore, it is quite uncertain how quickly the latest set of rules could take effect.

Russia Pushes Ahead Despite EU Sanctions

The country is not stepping back. Several new products related to crypto mining are taking the spotlight in Russia. More recently, a brokerage firm called Finam rolled out a fund that finances industrial-scale mining operations. It has even registered with the Bank of Russia.

Also Read: Dubai Greenlights Animoca Brands With Full VASP License

Russia’s access to cheap energy and cold climate could make the region a mining hub. This will allow investors to garner exposure to crypto assets without directly holding them. Even though the latest crypto sanctions that Russia is facing are designed to limit flexibility and access, the country seems to be finding a way.