Bitcoin dividends can be sustained indefinitely by Strategy Inc with just 1.25% annual Bitcoin appreciation, according to Executive Chairman Michael Saylor. The company holds 713,502 Bitcoin with a $54.26 billion acquisition cost, and this reserve alone covers 67 years of the firm’s $888 million annual Bitcoin dividends obligations. Strategy reported a $12.4 billion net loss during Q4 2025, yet the Bitcoin dividends model remains intact through a $2.25 billion cash reserve providing 30 months of coverage without touching Bitcoin holdings.

Saylor stated:

“Even if Bitcoin stopped appreciating entirely, Strategy would have 80 years to figure out what to do about that.”

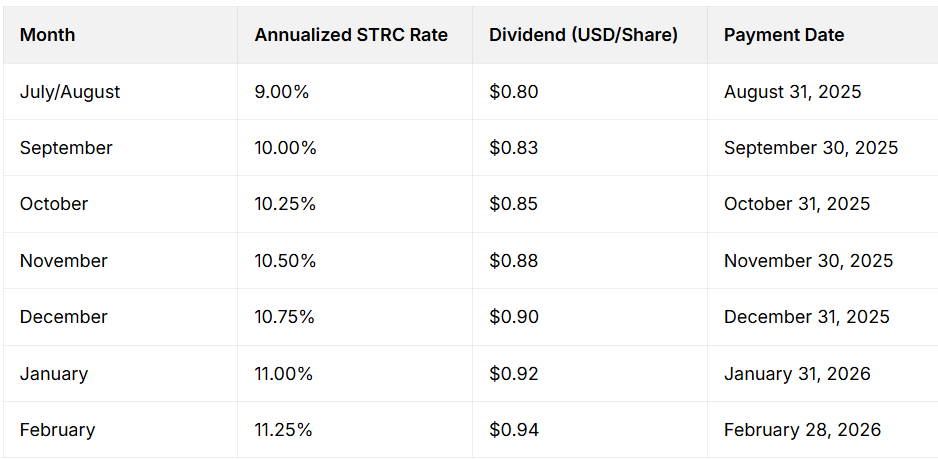

Note: Strategy (MSTR) stock does not pay traditional shareholder dividends. The Bitcoin dividends discussed refer to Strategy’s Stretch digital credit product, which is a separate financial instrument backed by the company’s 713,502 Bitcoin holdings that pays quarterly distributions at an 11.25% annualized rate.

Also Read: Why is Bitcoin Dropping? New Federal Reserve Chair Perhaps?

How Strategy’s Bitcoin Dividends Model Survives Earnings Volatility

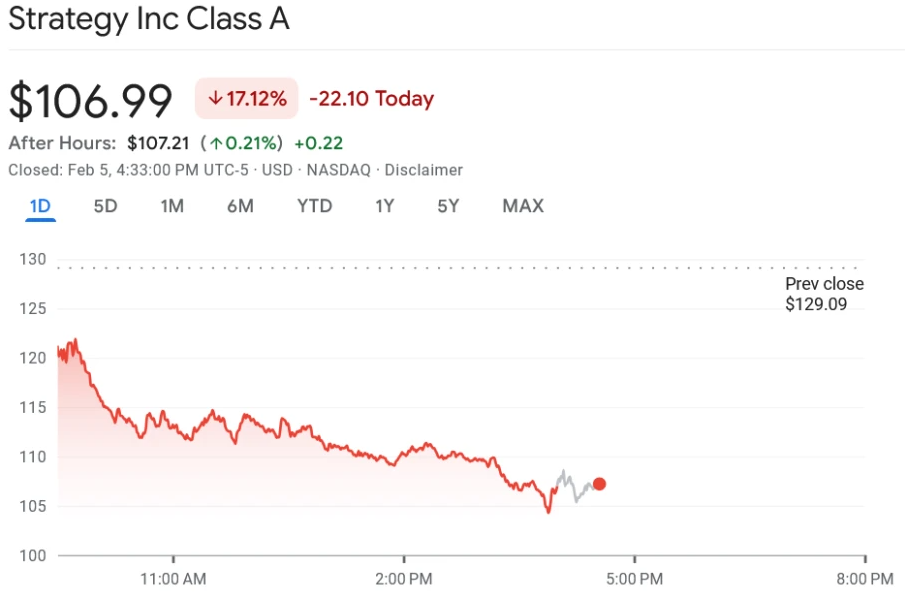

Strategy earnings revealed substantial losses driven by mark-to-market accounting, with a net loss of $12.6 billion and operating loss of $17.4 billion for Q4 2025. Bitcoin fell to $63,596.56 on February 6, 2026, marking a 13% single-day decline, yet CEO Phong Le explained the Bitcoin dividends sustainability framework during the earnings call. The company needs Bitcoin to increase by only 1.5% annually to maintain payments by selling incremental holdings, and with 67 years of dividend coverage from Bitcoin reserves, the Michael Saylor Bitcoin treasury strategy functions as designed.

Phong Le had this to say:

“I’m not worried, we’re not worried, and no, we’re not having issues.”

Also Read: What to Invest in 2026: The 14% Portfolio Gap No One Talks About

Bitcoin Dividends ETF and Financial Stability

Strategy operates with 13% net leverage, which includes $8.2 billion in convertible debt with a 42 basis point average interest rate, providing the financial foundation for its Bitcoin dividends ETF-like structure. This compares favorably to investment-grade companies at 23% leverage and high-yield companies at 32% leverage. Phong Le addressed downside scenarios, noting Bitcoin would need to decline 90% to approximately $8,000 before the Bitcoin reserve equals net debt obligations. The company raised $25.3 billion in capital during 2025 and added $3.9 billion in January 2026 despite market volatility, strengthening its ability to maintain BTC dividends through the Stretch product.

Andrew Kang stated:

“Strategy has built a digital fortress anchored by 713,502 Bitcoins and our shift to Digital Credit, which aligns with our indefinite Bitcoin horizon.”

How Often does Bitcoin Pay Dividends?

Strategy’s Stretch digital credit product offers BTC dividends ETF-like exposure with 7% volatility compared to Bitcoin’s 45% volatility, paying quarterly dividends at an 11.25% annualized rate across $888 million in annual obligations. The $3.4 billion instrument trades near its $100 stated amount and also provides insights into Bitcoin dividends history and future Bitcoin dividends ETF development, with 5.6x over-collateralization protecting investors.

The company’s $45 billion Bitcoin reserve provides 67 years of dividend coverage, and Strategy achieved a 22.8% BTC yield for 2025, which demonstrates its ability to acquire BTC faster than shareholder dilution occurs while maintaining dividend payments through minimal cryptocurrency appreciation requirements. The Michael Saylor Bitcoin approach continues through Strategy earnings showing operational software revenue of $477 million annually alongside the Bitcoin treasury strategy.

The Michael Saylor Bitcoin approach maintains dividend payments through minimal cryptocurrency appreciation requirements, with Strategy Inc earnings showing operational software revenue of $477 million annually alongside the Bitcoin treasury strategy.