SHIB’s price prediction for 2026 comes down to one straightforward question: Can Shiba Inu return to its all-time high? At the time of writing, SHIB is trading around $0.00000661, meaning $1,000 buys roughly 151.2 million tokens.

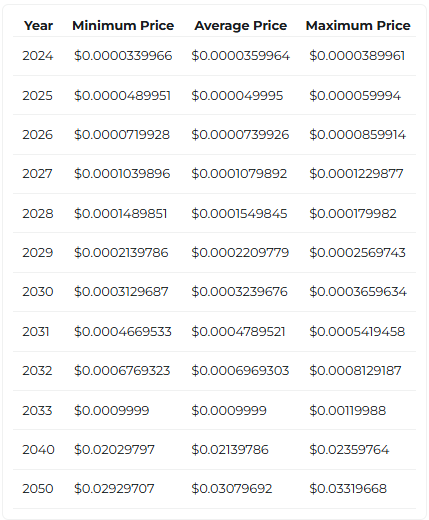

If those tokens are ever valued at the October 2021 ATH of $0.00008845, that position would be worth approximately $13,380, a 1,238% gain. The Shiba Inu price prediction from Changelly puts the 2026 maximum at $0.0000859914, just below that ATH level, and the SHIB forecast from Alibaba’s AI model called KIMI targets $0.000059 by year-end if key resistance is cleared.

Also Read: XRP Price Prediction 2026: What 1,000 XRP Could Be Worth

How SHIB’s 2026 Outlook Changes If It Returns to Its All-Time High

What the Numbers Actually Look Like

The SHIB price prediction 2026 ATH scenario delivers a clear 13.38× return on any position taken at today’s price. A $5,000 investment today turns into roughly $67,000 if SHIB reaches its all‑time high again. That math is what keeps the Shiba Inu price prediction conversation alive even after years of declining prices.

What Analysts Are Saying About the SHIB Forecast

Alibaba’s AI analysis flagged a key breakout level in the $0.000025 to $0.00003 range. A confirmed move above that could push SHIB toward $0.000059 by end of 2026, representing around 850% gains from current prices and placing the token just below its 2021 peak. CoinPaper also cited an analyst pointing to a possible 1,606% rally if SHIB repeats its 2021 accumulation pattern.

Also Read: Nvidia Nears $30B OpenAI Investment After $100B Funding Deal Stalls

The Conservative SHIB Price Prediction 2026

Not all models are bullish. Binance’s projection data shows SHIB potentially ranging between $0.000006 and $0.000008 through 2026 under a flat scenario, with meaningful upside only materializing if the broader crypto market turns risk-on.

The RSI at the time of writing sits around 41, below the neutral 50 line, and the $0.00003 resistance level has not been tested yet. Shibarium’s Layer-2 upgrade adds a utility argument that wasn’t there in 2021, delivering faster transactions, lower fees, and improved developer tooling, but that alone won’t move the price without broader market momentum behind it.

Also Read: White House Sets March 1 Deadline in Stablecoin Rewards Dispute as XRP, Coinbase Attend