In the past few years, stablecoins have witnessed a massive rise in adoption. They have moved beyond trading and investments and are becoming an integral part of daily finance. According to a report by BVNK and YouGov, 77% of those surveyed said they would open a crypto or stablecoin wallet within their banking or fintech app if offered the option.

The Stablecoin Utility Report 2026 is based on a crypto user survey of more than 4600 people across 15 countries.

The data shows an increase in stablecoin adoption in 2026, with 39% of respondents reporting that they now receive payments in stablecoins. The report also suggests that 49% have increased their stablecoin holdings in the past year.

Also Read: Russia’s $648M Crypto Explosion Just Hit Europe’s Sanctions Wall

How Stablecoin Adoption 2026 Shapes Payments, Bank Wallets, and Global Use

Stablecoins are cryptocurrencies pegged to a fiat currency, such as the USD. To achieve this, they are backed by reserves. According to The Block, stablecoins currently have a total supply of $292.66 billion, with USDT and USDC dominating the segment.

While their initial use case was limited to moving funds between exchanges, stablecoins are now finding increased adoption amongst people worldwide, and the report sheds light on that.

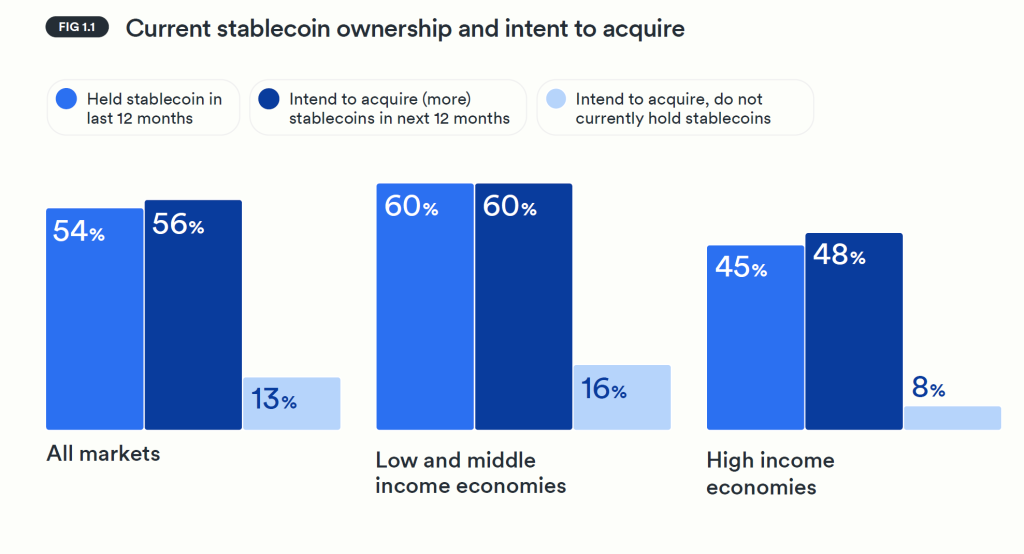

According to it, 56% of the current crypto or stablecoin holders plan to increase their holdings in the next year, and among those who don’t own for now, 13% intend to start.

The report also underlines another important aspect of stablecoin adoption. It shows that the intent to increase holdings or acquire stablecoin is higher in low and middle-income economies.

Also Read: Harvard’s $86.8M Ethereum ETF Move Follows 21% Bitcoin Reduction

Stabecoins Payments and Usage are on the Rise

The report then goes on to explore stablecoin payments. According to the survey, 45% convert the stablecoin into their local currency. On the other hand, 27% proceed directly with stablecoin payments, while roughly 10% neither spend nor convert.

Apart from that, 73% of the freelancers and gig workers surveyed reported that cryptocurrencies and stablecoins have enabled them to work more easily with global clients. This is primarily through cross-border stablecoin use for payments.

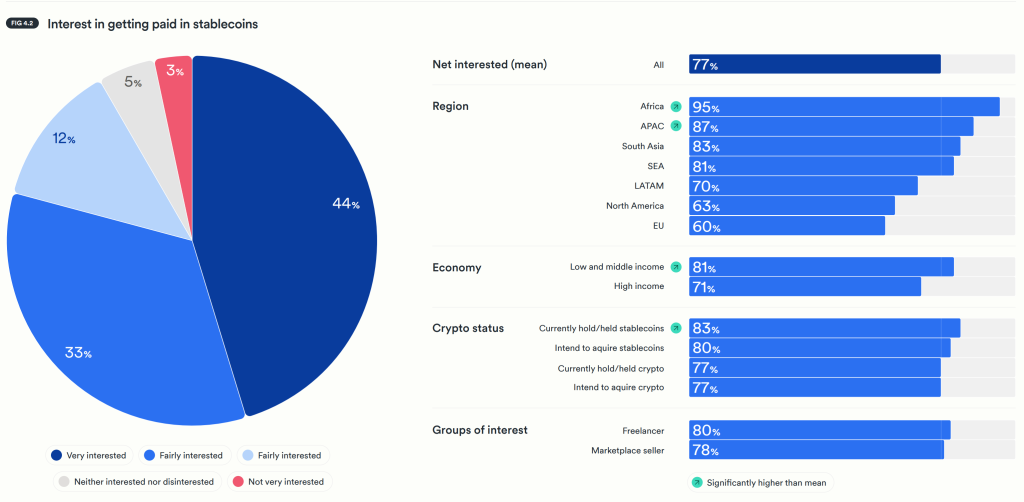

Additionally, 77% have shown interest in being paid in stablecoins. For low and middle-income economies, it stands at 81%, while for high-income economies, it is 71%.

Coming to bank stablecoin wallets, 77% have shown interest in opening one if it’s offered. Again, the percentage is higher in low and middle-income economies.

Also Read: 3 Space Defense Stocks to Buy After NASA’s Asteroid 2026 Warning

The report finds that lower transaction fees, better security, cross-border use, and faster transactions are the top reasons people use stablecoins. So, the stablecoin adoption in 2026 is largely fueled by the limitations of fiat currencies.

The stablecoin and crypto user survey report underscores that while stablecoin adoption is rising, users would prefer it to be integrated with their banks or fintech apps. This presents a massive opportunity, which, if tapped, could benefit all three: the stablecoin ecosystem, banks, and end users.