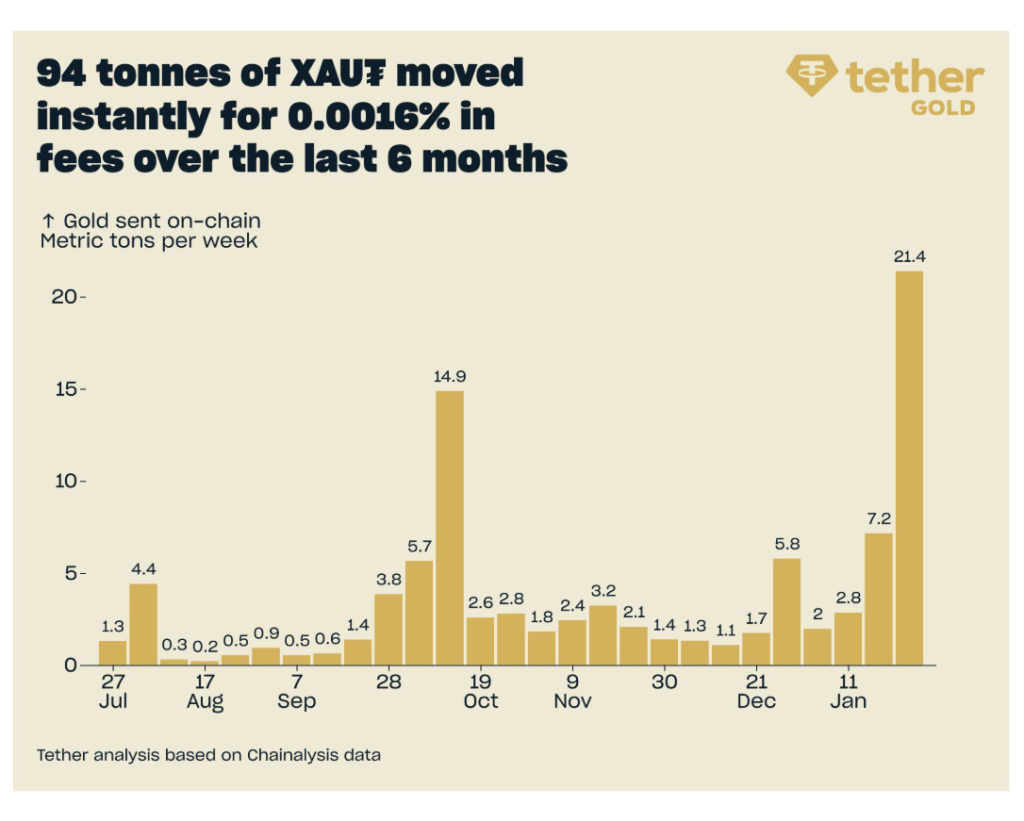

Tokenized gold 2026 is showing what gold-backed crypto can do at scale. Over the past six months, 94 tonnes of XAUT were settled on-chain instantly at just 0.0016% in fees, which is a figure that makes traditional gold settlement look slow and expensive by comparison. XAUT settlement volumes have been climbing steadily, and PAXG price 2026 data shows the broader tokenized gold adoption trend is accelerating across both institutional and retail markets.

Also Read: Arkham Says the Bear Market Is Here: Guide to Surviving the Crypto Cycle

Tokenized Gold Surges on Settlement Growth, Rising Prices, and Adoption

Tether’s Numbers Tell the Story

Cointelegraph reported that Paolo Ardoino had this to say:

“94 tonnes of XAUT moved instantly in the past six months for just 0.0016% in fees.”

Based on Chainalysis data, weekly XAUT settlement volumes peaked at 21.4 metric tonnes in late January 2026, up from under 0.5 tonnes during quieter stretches in August. That kind of tokenized gold 2026 activity at near-zero cost is something no traditional gold custodian currently offers.

Also Read: IMF Warns China’s Industrial Machine Is Reshaping Dollar Dominance

PAXG’s 2026 price figures sharpen the picture already painted PAXG was trading at around $4,863.86 as of early February, with a market cap between $2.01 and $2.03 billion and a 4x increase in active addresses recorded recently.

Who’s Moving Tokenized Gold and Why

Whale dominance in PAXG dropped from 99% to 72%, a sign that tokenized gold adoption is no longer just an institutional story. Retail investors are driving growth, XAUT settles at near-zero cost, and traders increasingly treat gold-backed crypto as a legitimate settlement layer rather than a speculative bet.Analysts project PAXG could reach $12,294.28 by end of 2026 if gold prices stay elevated.

Also Read: $2.5B Bitcoin Options Expiry Looms as Huge $40K Put Signals Volatility Risk

Tokenized gold 2026 momentum is real, and the on-chain data is backing that up week after week.