The BRICS Unit has been gearing up to dilute the dollar dominance and Western control, and this powerful bloc is preparing to introduce a gold-backed dollar alternative, ‘the Unit’. Following its expansion in 2025, the BRICS alliance officially became a 10-member state alliance; despite some conflicting reports of 11, with an additional 32 nations currently seeking membership. Now, backed by over 40% of the world’s population and accounting for over 39% of global GDP, this could finally be the golden move to de-dollarization.

What is the BRICS Gold-Backed Unit and How Does It Work?

BRICS has been in existence since 2001 as BRIC and later BRICS, with South Africa joining in 2010. The aim of the bloc was to enhance trade development within the group and increase its global influence. However, geopolitics, inflation and Western dominance have made it difficult for BRICS to successfully establish a counter currency. The BRICS economies are plagued by persistent weakness and volatility in their currencies, making them unable to compete with the dollar. Since its inception, BRICS has managed to build a credible platform for coordination among member countries. However, it has been unable to create a structure with full economic integration that is independent of the U.S. domination.

The issue with the dollar as the dominating currency exposes other economies to its monetary policies and interest rates. And if you’ve been following up on the U.S. trade news, you’re aware of the Trump tariffs. These disrupted global supply chains and exposed the vulnerabilities of dollar-dependent trade.

This necessitated alternative settlement mechanisms among emerging economies and hence the birth of the BRICS Unit currency. The BRICS unit launch date is yet to be officially communicated. But in the last quarter of 2025, the BRICS Unit token got a go-ahead from the International Research Institute for Advanced Systems (IRIAS) to launch and conduct a pilot test in November 2025. The test would consist of the digital token represented by a hybrid BRICS currency. With 100 gold-backed token units, each tied to a gram of gold, the prototype was launched.

The BRICS Unit Value vs The USD

BRICS comprises five currencies: Brazilian Real (BRL), Russian Ruble (RUB), Indian Rupee (INR), Chinese Yuan (CNY) and South African Rand (ZAR). Individually, these currencies have their own pros and cons. However, when gold is included, the structure shifts and any shocks, whether gold or currency-targeted, are absorbed more effectively, preserving the overall value of the BRICS unit value.

This BRICS Unit currency is meant to revolutionize how these countries conduct cross-border trade because the Unit value will be anchored 40% gold and 60% BRICS currencies. The idea behind using a BRICS Unit token structure is an excellent way to bypass liquidity shortages, inflation and destabilization.

What the BRICS unit needs to do is destabilize the dollar. The Unit will not be interfering with local currencies, hence creating a blockchain. And because it is meant for wholesale transactions, it will bypass Western sanctions. To make the deal even sweeter, the development of the Unit will be overseen by an AI CEO to maintain neutrality and analytical precision. If more countries warm up to the gold-backed BRICS unit tokens, the U.S. ceases its monopoly power because the dollar’s demand will be significantly reduced.

And with the U.S. dollar facing fiscal and geopolitical turmoil, emerging economies will be leaning more toward the BRICS Unit currency to cushion themselves while aiming for financial sovereignty.

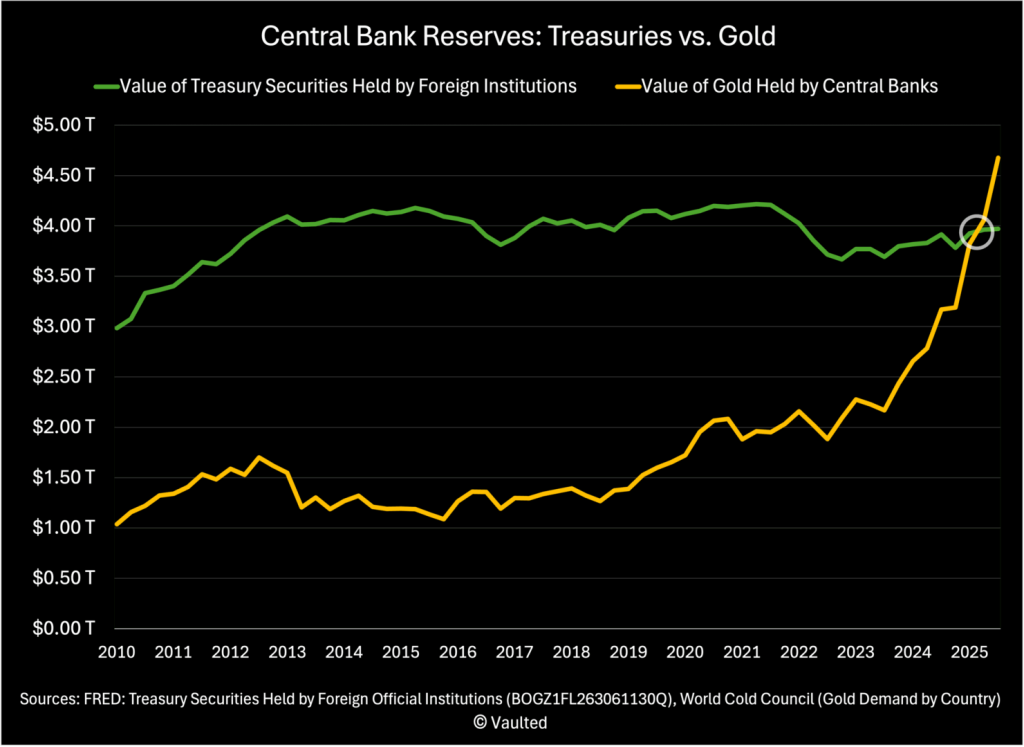

Strategic Accumulation of Gold Reserves

The BRICS Unit currency structure challenges the status quo and systems that have been in place for decades. And with central banks across the BRICS economies slowly accumulating gold reserves, the groundwork is being laid. Soon, there will be a system that relies less on single-currency issuers and leans more toward neutral, asset-anchored settlement mechanisms.

As of November 2025, global central banks had acquired gold reserves worth $4.5 trillion. This is pretty impressive for an emerging market. Infact, the USD’s share in global FX reserves has fallen to a two-decade low. This action stems from the fear that existing dollar reserves are at risk and could be lost at anytime. Acquiring gold is a safety net for financial institutions in an era where inflation is unpredictable and the demand for gold is steadily rising.

BRICS countries are yet to overtake the U.S. treasuries and probably won’t soon. However, the move to accelerate their reserves accumulation and diversification is a step in the right direction. It gives them a fighting chance in reducing the U.S. debt exposure. Once they increase their membership, the BRICS bloc could significantly boost its collective economic and financial weight and leverage its larger combined reserves.

The BRICS gold-backed Unit Launch Date

All these details and possible outcomes seem juicy, but when is the real thing happening? The BRICS Unit is still very much a prototype, and nothing full-scale has been adopted or mandated yet.

Even though there is no official BRICS Unit launch date, there could be more information at the upcoming 18th BRICS Summit to be held in India this year.

And while this may come into fruition, coordinating a global, hybrid currency is no easy feat. There are many economies involved, and more waiting to join the bloc. Consensus on rules and management of the Unit could delay the official launch date.

Still, the BRICS gold-backed Unit may be risky, but a much-needed step toward de-dollarization. The BRICS Unit could gradually reshape cross-border trade and monetary systems. For now, it’s a wait-and-see game.