Trump’s UFO disclosure became official on February 20, when President Donald Trump announced he is directing federal agencies to release government files on extraterrestrial life, UAP, and UFOs. The move puts defense stocks and aerospace stocks directly in focus, with investors watching whether the order could accelerate spending on detection systems, surveillance, and AI-powered analytics. Palantir stock and Lockheed Martin stock are among the names getting the most attention.

Trump stated:

“Based on the tremendous interest shown, I will be directing the Secretary of War, and other relevant Departments and Agencies, to begin the process of identifying and releasing Government files related to alien and extraterrestrial life, unidentified aerial phenomena (UAP), and unidentified flying objects (UFOs), and any and all other information connected to these highly complex, but extremely interesting and important, matters.”

Rep. Nancy Mace said:

“Tonight, President Trump is directing full disclosure of UAP and UFO files. In October, I wrote to DoD, CIA, NSA, and DNI demanding exactly that. The truth belongs to the American people.”

Also Read: Billionaire Ambani Leads Reliance Industries’ $110B AI Push, RELIANCE.NS Rises

How Trump UFO Disclosure Impacts Defense and Aerospace Stocks

Trump’s UFO disclosure is being read by markets as a potential trigger for new defense and aerospace spending cycles. Defense stocks were already trending higher in the days leading up to the announcement.

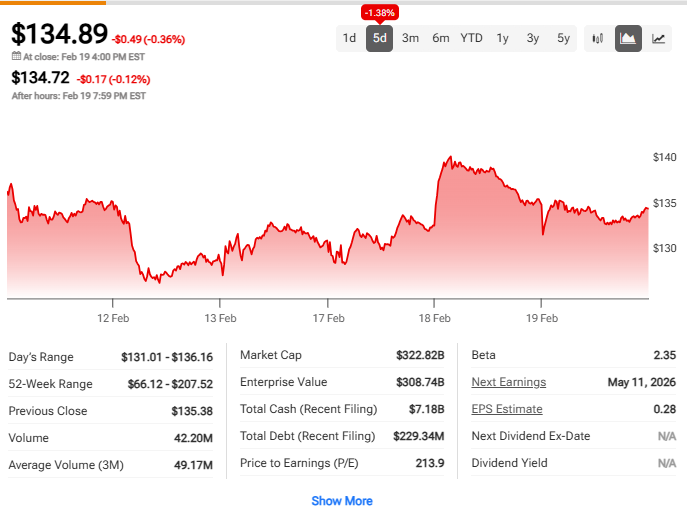

1. Palantir Stock (PLTR)

Palantir stock closed at $134.89 on February 19. Its AI defense contracts position it as a direct beneficiary of any expanded UAP program. Wall Street has a Moderate Buy consensus with an average 12-month target of $191.25, representing 41.78% upside.

Also Read: Deutsche Bank Backs Ripple as JPMorgan Helps SWIFT Build Rival Blockchain Rails

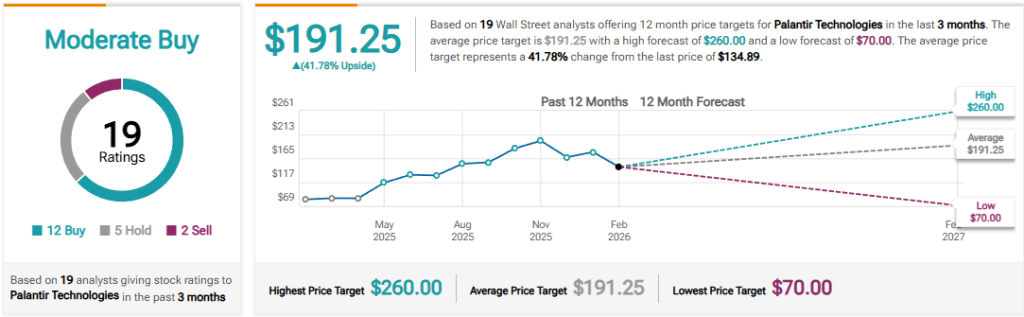

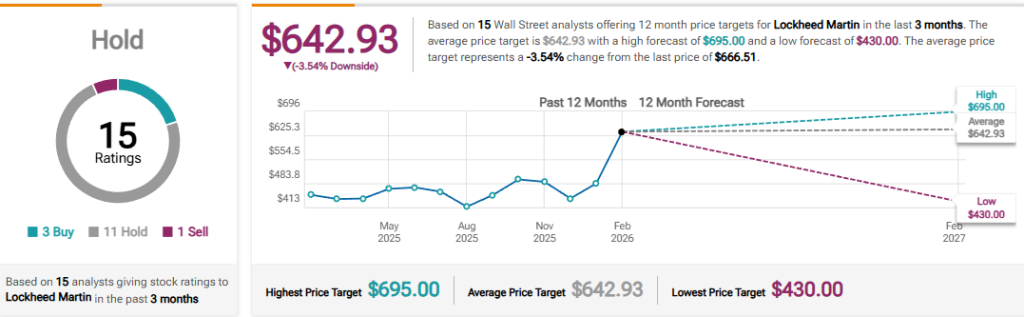

2. Lockheed Martin (LMT)

Lockheed Martin stock gained 6.18% over five days to close at $666.51, with analysts carrying a Hold consensus and an average target of $642.93.

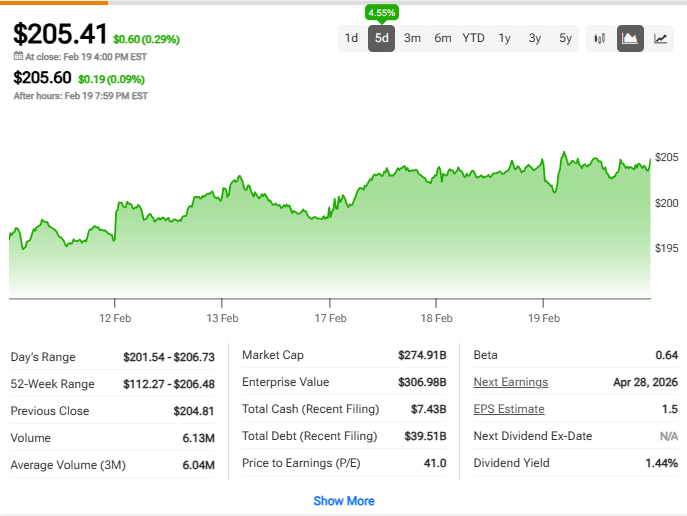

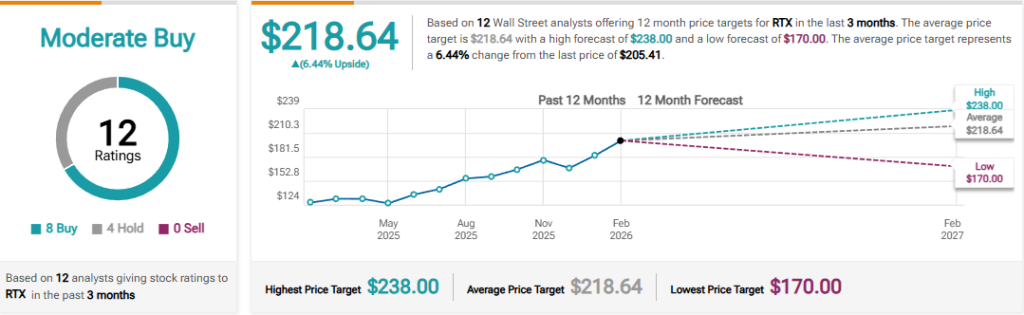

3. RTX

The RTX stock added 4.55% over five days to $205.41. Eight of 12 analysts rate it a buy, with an average target of $218.64 and zero sell ratings.

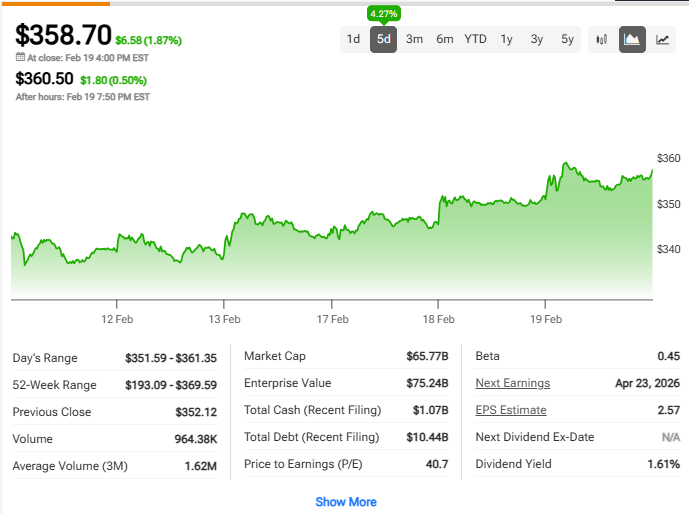

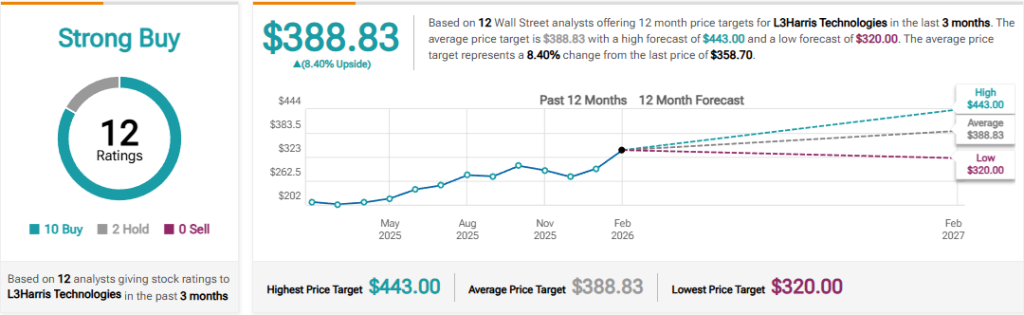

4. L3Harris (LHX)

L3Harris Technologies rose 4.27% to $358.70, carrying a Strong Buy from 10 of 12 analysts and an average target of $388.83. The Trump UFO disclosure narrative plays directly into its surveillance and reconnaissance business.

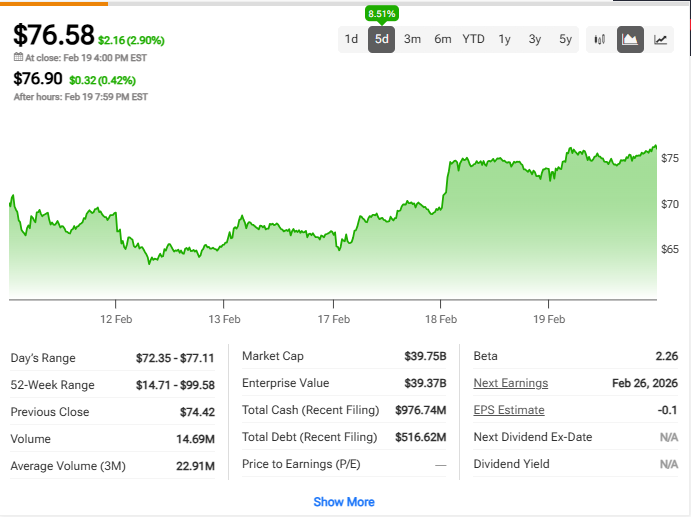

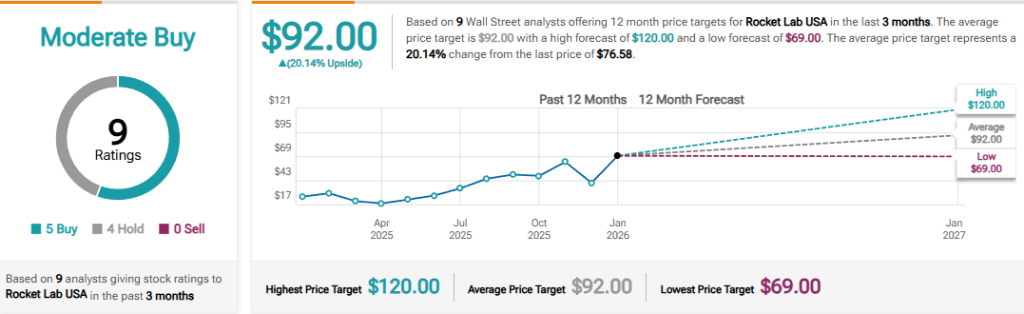

5. Rocket Lab (RKLB)

Rocket Lab USA was the strongest mover in the group, up 8.51% over five days to $76.58. Analysts see 20.14% upside from current levels, with a $92.00 average target and a Moderate Buy consensus.

Also Read: Goldman Sachs CEO David Solomon Owns Small Bitcoin Stake, Watching Closely