Finding what to invest in 2026 means addressing a critical timing window: JPMorgan predicts a 3% dollar decline through mid-2026, but most portfolios hold only 21% international exposure versus a 35% benchmark, which is a 14 percentage point underweight. With the dollar trading around 96–98 on the DXY index in early 2026 and Fed easing accelerating the decline, three specific portfolio gaps are actually being created.

The best stocks to buy in 2026 include Nvidia and Taiwan Semiconductor for technology exposure, along with The Trade Desk for advertising technology, and also MercadoLibre for Latin American e-commerce. Top ETFs to invest in 2026 span S&P 500 index funds and international equity vehicles, while decisions to invest in gold point toward mining stocks such as AngloGold Ashanti and Coeur Mining. More on these below.

Also Read: 3 US Dollar Rate Levels: Weakening Dollar Triggers Currency Wars

Where To Invest in 2026 With Top Stocks, ETFs and Gold

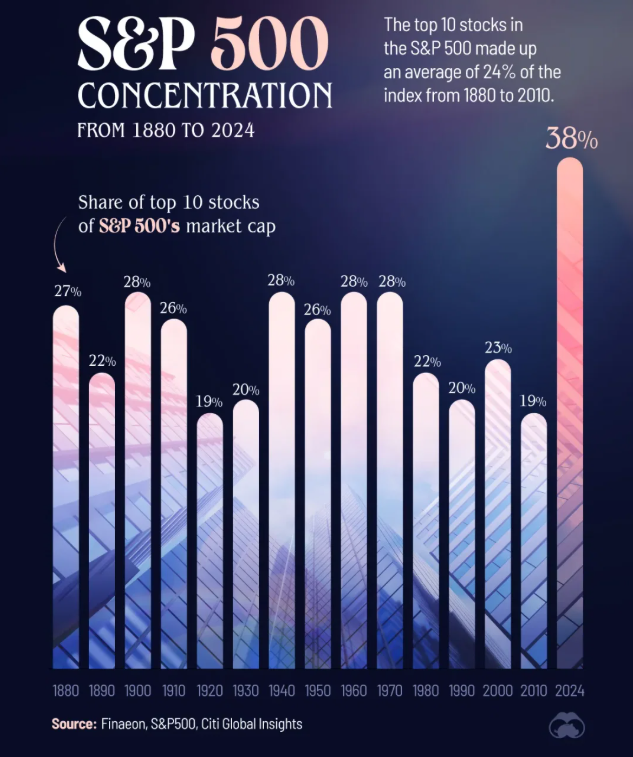

Dollar’s Weakness Exposes S&P 500 Concentration Risk

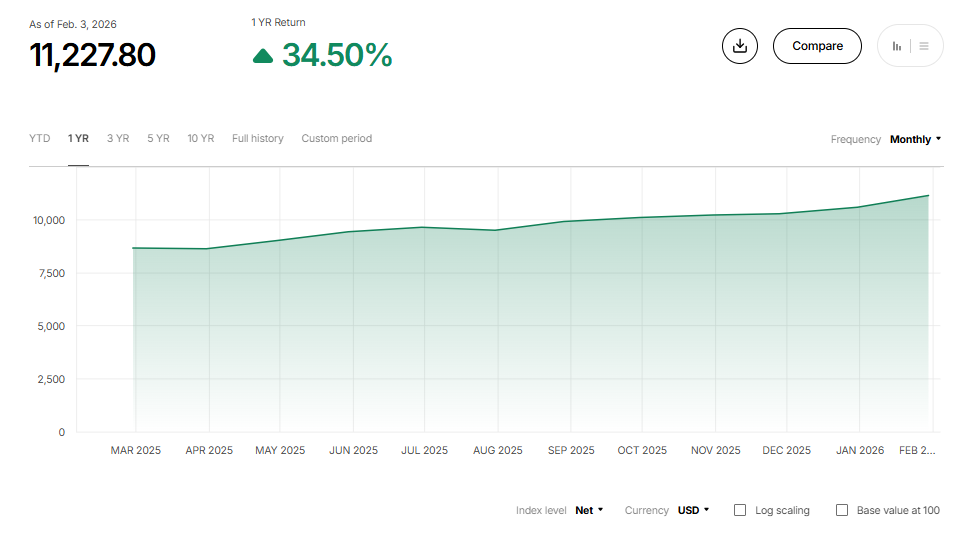

When figuring out what to invest in 2026, the dollar’s trajectory matters. Trading around 96-98 on the DXY index in January 2026, the greenback is facing downward pressure from Federal Reserve easing cycles. JPMorgan Asset Management predicts a 3% decline through mid-2026, but the real story isn’t even the percentage, it’s what happens to portfolios concentrated in U.S. assets when that decline accelerates.

The numbers reveal the problem. The top 10 stocks now represent 40% of the S&P 500 index. JP Morgan’s analysis shows the top 20 stocks account for 50.8% of the index. Investors now hold an average of $400,000 concentrated in just 10 stocks per $1 million invested. The effective number of portfolio contributors has actually been reduced to just 10% over the past 15 years.

Apple and Berkshire Hathaway remain top holdings for many investors. A Motley Fool analyst noted that these companies offer exposure to secular trends while also maintaining financial stability. However, this concentration creates currency exposure that most investors don’t actually recognize. When the dollar weakens and the Fed continues easing, international assets are benefited twice from their own performance and also from currency translation gains.

Right now, most advisor portfolios show massive gaps in three specific areas that dollar weakness makes more valuable: international equities at 21% versus 35% benchmark, alternatives at 8% versus 18% model portfolios, and even gold mining stocks that remain systematically absent despite strong fundamentals.

The Best Stocks To Invest In 2026: Technology and AI Leaders

1. Nvidia (NVDA)

Nvidia remains a must-own for nearly every investor according to recent analysis. The company is traded around $190 per share and continues to dominate AI computing. Wall Street analysts expect 67% growth in the fourth quarter and 52% growth in fiscal year 2027. This indicates the AI buildout still has significant room to run, and if it does, Nvidia is positioned as a top option to invest in.

2. Taiwan Semiconductor (TSMC)

Taiwan Semiconductor Manufacturing Company reported fourth-quarter results showing 26% year-over-year revenue growth in U.S. dollars. Management guided to nearly 30% revenue growth in 2026, with plans to spend $52 billion to $56 billion on production capabilities throughout the year. This spending actually demonstrates huge and lasting chip demand in the AI space, giving further credence to the idea that AI spending is just getting started.

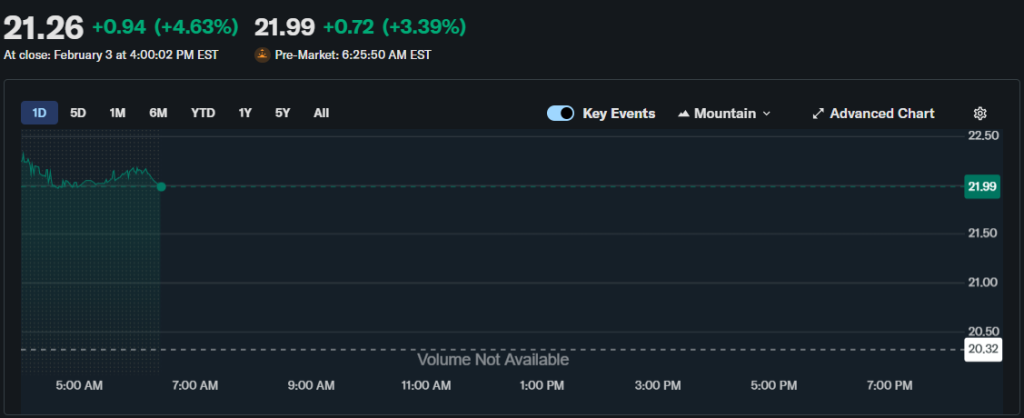

3. Nebius Group

Nebius Group deploys Nvidia GPUs filled with TSMC chips to be rented out to clients looking for AI training power. This business model is similar to the already proven cloud computing one that several big tech companies use. Demand for Nebius’ platform to expand is incredible, and management believes it will grow from a $551 million annual run rate at the end of the third quarter to a $7 billion to $9 billion run rate at the end of the year.

Diversified Growth Beyond Mega-Cap Concentration

1. Nvidia (Fractional Shares)

2. PayPal (PYPL)

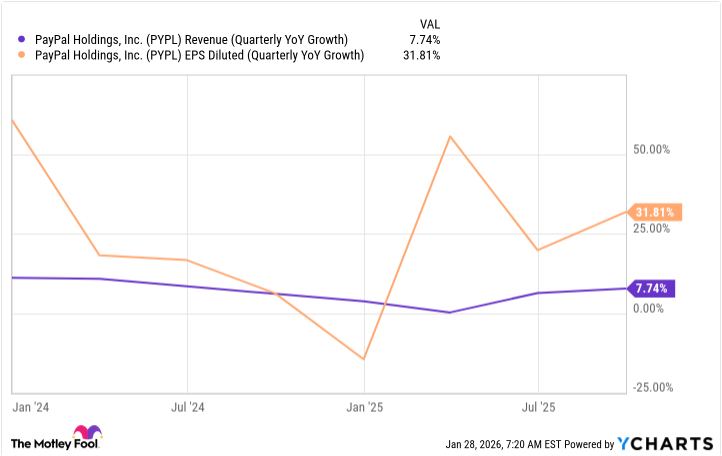

PayPal trades around $55 per share and offers high single-digit revenue growth with aggressive share buybacks driving earnings per share higher.

The stock is actually traded at less than 10 times forward earnings – an absolute steal of a price that investors should be flocking to.

3. Amazon (AMZN)

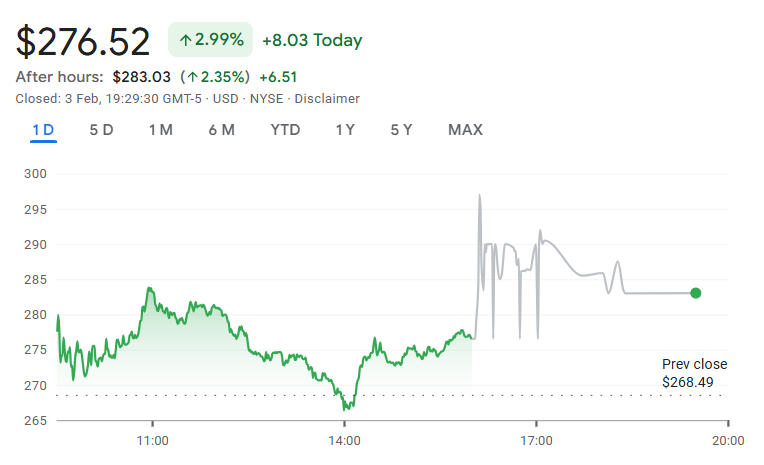

Amazon rounds out the recommendations at around $245 per share. The e-commerce giant was viewed as a poor performer in 2025, losing to the market even despite delivering positive returns. However, 2026 could be the year it soars, because its cloud computing business is starting to accelerate alongside high execution in commerce segments.

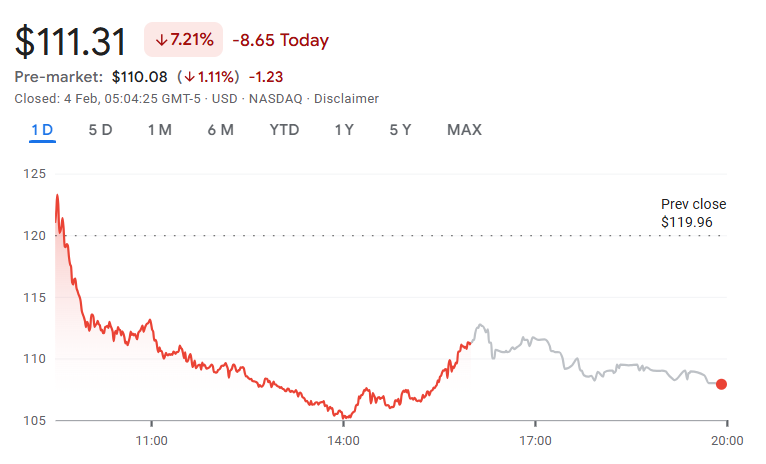

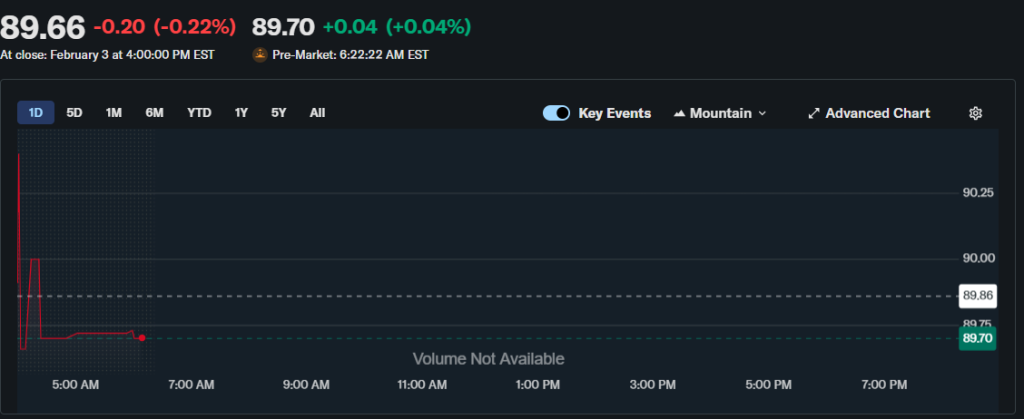

4. The Trade Desk (TTD)

The Trade Desk had an abysmal 2025, falling nearly 70% from its peaks. However, Wall Street analysts still expect 18% revenue growth for this year and also 16% next year. The demand for ad technology software is still growing, and The Trade Desk is positioned to capture it. Trading at about 17.5 times forward earnings, the stock represents an absolute value opportunity in a sector with strong fundamentals.

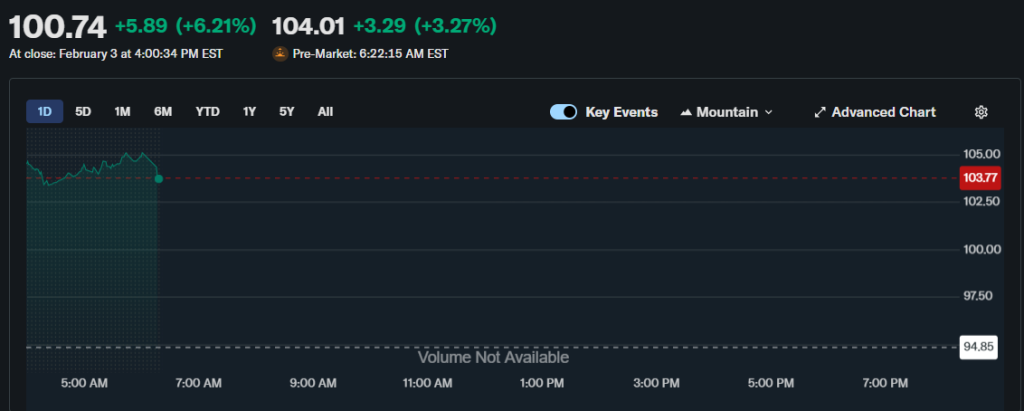

5. MercadoLibre (MELI)

MercadoLibre offers diversification by providing exposure to Latin America rather than U.S. markets. The company has built itself into an e-commerce giant, complete with a fintech platform. The stock is down around 20% recently, which happens now and again because the market sometimes forgets it’s not associated with U.S. dynamics. This makes it a perfect buying opportunity, as the company has a fantastic record of business expansion.

Growth Stocks Filling Systematic Portfolio Gaps

1. Ciena (CIEN)

Ciena sells high-speed optical networking gear, and its growth profile improves when hyperscalers and service providers refresh capacity for AI-driven traffic. Latest results showed strong year-over-year revenue growth, with management’s forward outlook actually implying another step-up in sales. The company is cited as seeing durable demand from cloud customers and expanding opportunities inside and around the data center.

2. Credo Technology (CRDO)

Credo Technology designs energy-efficient high-speed connectivity for AI-driven cloud networks. Latest results were record-setting, with revenue and earnings surging from the prior year. Management guided to another strong sequential step-up, reflecting broad demand for connectivity solutions. The company holds a material net-cash balance sheet that adds flexibility to invest through the cycle.

3. Alcoa (AA)

Alcoa produces bauxite, alumina, and also aluminum, giving it operating leverage to improved metals markets. Recent results showed clear improvement in profitability and cash generation, aided by operational execution. Management continued reducing debt while reshaping the company’s footprint through strategic transactions and even facility optimization.

These names help answer what to invest in to make money by providing growth exposure outside the mega-cap concentration. They benefit from infrastructure spending, AI deployment, and commodity cycle improvements while trading at more attractive valuations than the top 10 stocks.

Alternative Investments Close the 8% Versus 18% Gap

High-Yield Savings Accounts

High-yield savings accounts offer one alternative that continues providing competitive returns. Analysis shows these accounts still offer elevated rates compared to the earlier low-rate environment, with online banks typically offering much higher interest rates than traditional brick-and-mortar institutions. Rates remain at levels that provide actual income, making savings accounts attractive for conservative allocations.

Certificates of Deposit (CD Ladders)

Certificates of deposit provide another alternative for risk-averse investors seeking guaranteed returns. A CD ladder ensures money is always coming in with reliable cash payments that are backed by FDIC insurance. This strategy works well when interest rate direction is uncertain – you’re effectively diversifying your risk by staggering maturities across multiple years.

REIT Index Funds

Real estate investment trust index funds offer exposure to property markets without direct ownership complexity. REIT funds pay substantial dividends while also providing some capital appreciation potential over time. After hard years amid rising rates, REITs have performed better recently as rate expectations shifted. These funds help move portfolios from the current 8% alternatives allocation toward the 18% target.

Commodity Funds

For commodity exposure, investors can access broad baskets through specialized funds. As the dollar declines from 108 on the DXY, commodities priced in dollars become cheaper for international buyers. This dynamic actually drives demand and supports prices, creating tailwinds for alternative investments that most portfolios are systematically underweight.

Whether To Invest In Gold Through Mining Stocks

1. AngloGold Ashanti

AngloGold Ashanti is classified as a diversified gold miner with earnings leverage to bullion and also improving cash returns. In the latest results, production rose from the prior year, and the company captured higher realized prices with tight cost control.

This combination drove sharply higher EBITDA and even record free cash flow, supporting a sizable dividend and net-cash position. Management reaffirmed full-year guidance while the portfolio benefited from solid performance at core mines.

2. Coeur Mining

Coeur Mining offers high operating leverage as a growing precious metals producer. The company’s approved acquisition of New Gold, set to close in H1 2026, will expand scale and also add meaningful copper exposure.

Pre-merger results already showed record production, margin gains, along with cash flow jumps, and debt paydown. The combination of organic growth and strategic acquisition positions the company for continued expansion.

These mining stocks benefit as Fed easing supports gold through lower opportunity costs. Dollar weakness makes gold cheaper in other currencies, actually driving international demand. What to invest in 2026 for gold exposure includes both the miners generating record cash flow and also the metal itself as portfolio insurance against currency debasement.

The Best ETFs To Invest In 2026 for Systematic Gap-Filling

1. S&P 500 Index Funds

Selecting the best ETFs to invest in 2026 means addressing specific portfolio gaps with low-cost, diversified funds. S&P 500 index funds provide broad U.S. equity exposure with the market’s top companies. These funds offer immediate diversification and have been shown to return about 10% annually over time. They can be purchased with very low expense ratios, making them cost-effective core holdings.

2. Nasdaq-100 Index Funds

Nasdaq-100 index funds target the exchange’s 100 largest companies, meaning they’re among the most successful and stable technology businesses. Companies such as Apple, Microsoft, and also Nvidia comprise large portions of the total index. Nasdaq-100 ETF funds offers immediate diversification within the technology sector, providing exposure to innovation and growth at scale.

3. Developed Market International Funds

For international exposure addressing the 14 percentage point gap, developed market funds provide access to European and Asian blue chips. These funds help move portfolios from the current 21% international allocation toward the 35% benchmark, capturing both valuation opportunities and even currency diversification benefits.

4. REIT Index Funds

REIT index funds offer property exposure without concentration risk or direct ownership complexity. These funds pay substantial dividends from rental income while also providing potential capital appreciation. They help close the alternatives gap by moving portfolios from 8% toward the 18% target allocation.

Currency Thresholds Create Investment Timing Urgency

Determining what to invest in 2026 requires recognizing currency war mechanics and specific intervention thresholds. As the dollar declines from 108 on the DXY toward JPMorgan’s 3% target around 104-105, three critical levels emerge where other central banks face pressure to act.

The euro strengthening toward 1.15 to the dollar creates export competitiveness concerns for European manufacturers. This threshold represents a level where European Central Bank intervention becomes more likely to prevent excessive currency strength that hurts exporters.

The yen moving toward 140 to the dollar represents another critical threshold. Japanese exporters benefit from yen weakness, but rapid moves toward 140 actually trigger intervention risk as the Bank of Japan seeks to maintain stability and prevent excessive volatility.

The yuan appreciating beyond 6.80 to the dollar would signal Chinese central bank tolerance for currency strength. This level matters because it affects China’s export competitiveness and also influences trade dynamics across Asia.

These thresholds matter for portfolio construction and timing. Taiwan Semiconductor, already reporting 26% growth and guiding to 30% for 2026, benefits from both chip demand and currency dynamics as a Taiwan-listed company. The best stocks to invest in 2026 include names with international revenue streams that benefit from dollar weakness before intervention thresholds trigger volatility.

Practical Steps for Closing Portfolio Gaps

Before chasing performance or picking new assets, you need to understand where your portfolio is structurally weak. That means identifying missing exposures, underweight allocations, and blind spots that could be dragging down long-term returns. Start with these:

- Check for gold mining exposure

- Calculate your international exposure as a percentage of total equities

- Compare your alternatives allocation to the 18% model portfolio target

The 14 percentage point international underweight costs real returns when those markets outperform or when currency translation provides additional gains. The 10 percentage point alternatives underweight leaves portfolios overexposed to concentrated U.S. equity risk without the diversification benefits that real estate, commodities, and infrastructure provide. The complete absence of gold mining exposure means missing an entire sector showing strong fundamentals and even record cash flow generation.

For investors with $500 to invest this February, practical guidance is provided by recent analysis. Nvidia at $190 allows fractional share purchases in the AI leader. PayPal at $55 offers value exposure with aggressive buybacks driving earnings growth. Amazon at $245 provides diversified exposure to e-commerce and also cloud computing. These positions can be accumulated over time through systematic dollar-cost averaging.

The Trade Desk at 17.5 times forward earnings represents advertising technology exposure at attractive valuations. MercadoLibre provides geographic diversification into Latin American markets with strong growth potential. AngloGold Ashanti and Coeur Mining offer gold sector exposure with companies generating record cash flow.

Why Systematic Gap-Filling Beats Performance Chasing

The investment environment in 2026 rewards systematic gap-filling over performance chasing. When JP Morgan shows the top 20 stocks at 50.8% of the index, concentration has actually been pushed to extreme levels by historical standards. The best stocks to invest in 2026 aren’t necessarily the highest recent performers – they’re the ones filling specific gaps that data shows exist.

The systematic gaps of 21% versus 35% international, 8% versus 18% alternatives, and even absent gold mining exposure, all become more costly as currency dynamics shift and dollar weakness accelerates. Nvidia’s dominance in AI computing matters, but so does Taiwan Semiconductor’s production capacity and international presence. PayPal’s valuation at 10 times forward earnings looks attractive, but Amazon’s diversified revenue streams provide multiple growth vectors.

Conclusion

Tax efficiency matters when rebalancing to close these gaps. Using new contributions to build underweight positions avoids triggering capital gains while gradually achieving desired allocation targets. Adding international, alternatives, and also mining exposure with fresh capital creates the target portfolio over time without tax consequences.

Right now, successful investing means deploying capital into specific positions that close measurable gaps while positioning for the dollar weakness JPMorgan predicts. The opportunities exist in named stocks mentioned in this article, and not in adding to the 40% concentration that dominates indexes and creates systematic portfolio risk.