The White House wants answers. Officials have given banks and cryptocurrency firms until March 1 to settle the ongoing stablecoin rewards dispute. This disagreement has quietly turned into one of the last major barriers to passing broader crypto legislation in the U.S.

It should be noted that several meetings have already taken place. Industry executives, regulators, and bank representatives have all been moving in and out of meetings. The tone has improved, but the disagreement stays put. Banks do not want stablecoins offering rewards. But crypto firms believe these rewards are essential. Ji Kim, the CEO of the Crypto Council for Innovation, who has been part of these meetings, said,

“Today’s constructive meeting at the White House reflects the importance of focused working engagement. The conversation built upon previous meetings to establish a framework that serves American consumers while reinforcing U.S. competitiveness.”

Also Read: Trump Orders UFO Disclosure, Putting Defense and Aerospace Stocks in Focus

How the Stablecoin Rewards Dispute and Regulation Impact XRP and Coinbase

The latest standoff is slowing progress on the Clarity Act. The bill is designed to finally establish clear stablecoin regulation. It also aids in defining which agencies oversee different parts of the crypto market. For several years, that uncertainty has been a major concern for companies and investors.

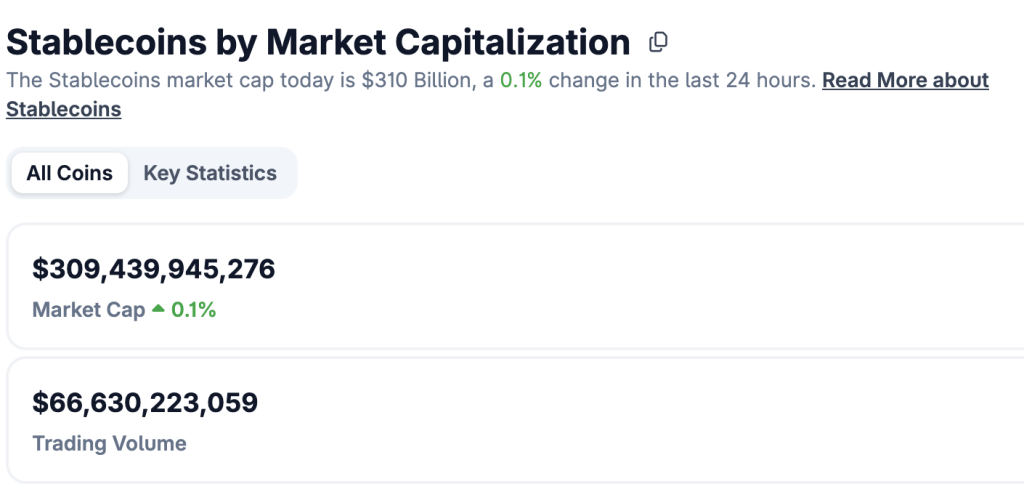

Stablecoins are currently too big to ignore. Their total market value is above $309 billion, according to data from CoinGecko. That number shows how deeply stablecoins are tied to crypto trading and payments.

The White House has also included Coinbase in these meetings. Coinbase is directly impacted. The exchange offers products tied to stablecoin rewards. Any restriction would impact the work of these products. Coinbase’s chief legal officer, Paul Grewal, said the discussions were constructive. He also made it clear that no final agreemnts exists yet.

Also Read: Goldman Sachs CEO David Solomon Owns Small Bitcoin Stake, Watching Closely

Ripple’s involvement has also generated fresh XRP news. XRP has spent years under regulatory pressure. Now, Ripple is part of conversations shaping future crypto rules. That shift matters. It shows regulators are engaging more directly with major crypto firms.

Meanwhile, prediction markets reflect rising expectations. On Polymarket, the odds of crypto market structure legislation passing this year recently climbed to 83%. Traders are betting that Washington will reach a decision.

Still, nothing is guaranteed. Lawmakers must agree on final terms. Political divisions remain. Some officials want stricter regulations, while others want to uphold innovation. But the outcome of this stablecoin rewards dispute will certainly shape what comes next.

Also Read: Deutsche Bank Backs Ripple as JPMorgan Helps SWIFT Build Rival Blockchain Rails