XRP borrowing has officially launched on the Flare blockchain, and it’s bringing new opportunities for holders who want to earn yield without actually selling their positions. The integration with Morpho, which is a modular lending protocol, introduces XRP lending and borrowing capabilities for FXRP holders right now. What this means is that users can earn FXRP yield and also access XRP collateral loan options, which has been something the community has been waiting for.

Earn FXRP Yield And Explore XRP Lending And Borrowing With Collateral Loans

How XRP Borrowing Works Through Modular Markets

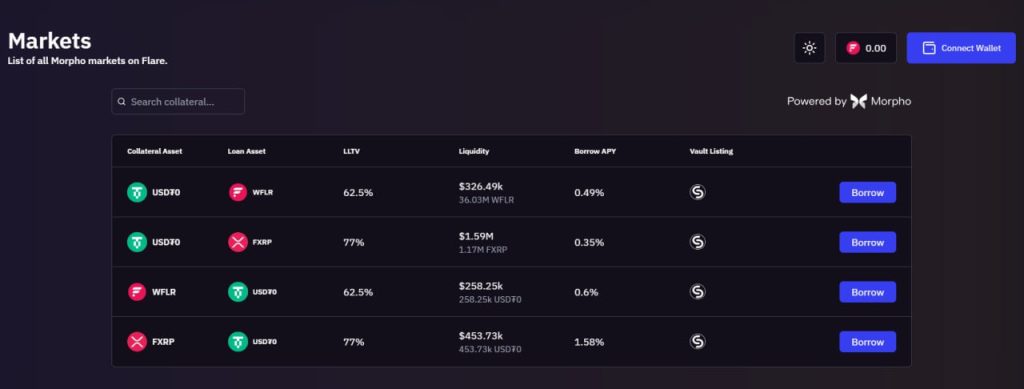

The XRP borrowing system operates through what’s called Morpho’s modular architecture, and each lending market pairs one collateral asset with one borrowed asset. This isolated design prevents risk contagion across markets, which addresses some of the security concerns that have affected traditional DeFi protocols over the years. FXRP holders can now deposit their tokens into curated vaults to earn FXRP yield, or they can use their assets as collateral for an XRP collateral loan to borrow stablecoins such as USDT0 and other supported assets.

How XRP Borrowing Markets Set Risk and Loan Limits

What makes this system different from traditional lending platforms is the way it structures individual markets. Each market has its own loan-to-value ratio, which determines how much users can borrow against their collateral. The rates vary depending on the specific asset pair and the current supply and demand dynamics within that particular market. This means borrowers have multiple options to choose from based on their risk tolerance and capital needs.

Hugo Philion, CEO of Flare, stated:

“XRP plays a key role in the emerging digital economy, especially in the DeFi space.”

Mystic is serving as the primary interface for accessing these markets at launch, and independent curators like Clearstar offer vault strategies with FXRP, FLR, and also USDT0 backing them. The setup allows capital to loop across staking, lending, and borrowing within a single DeFi XRP ecosystem, which gives users more flexibility than before.

The current markets on Flare include various collateral and loan asset combinations, with liquidity ranging across different pairs and borrowing rates that adjust based on market utilization. This flexibility gives XRP holders unprecedented control over how they deploy their capital.

The interface displays real-time information about each market, including the loan-to-value ratios, total liquidity available, and the annual percentage yields for borrowers. This transparency helps users make informed decisions about which markets to participate in and they can keep an eye on all their different positions at once without switching between multiple platforms.

New Opportunities for XRP Holders

The XRP lending and borrowing integration is transforming how XRP functions in decentralized finance at the time of writing. Users can maintain their XRP on the XRP Ledger and work with FXRP on Flare’s smart contract network, which unlocks on-chain utility that was previously unavailable for this asset. Markets can launch permissionlessly under this system, and curated vaults allocate capital based on defined risk parameters that match different user preferences.

The actual deployment extends Flare’s existing infrastructure for DeFi XRP applications, which already includes staking through Firelight, spot trading via Hyperliquid, and yield tokenization through Spectra. By combining these tools together, XRP borrowing enables more sophisticated financial strategies for an asset that historically offered quite limited DeFi options compared to other major cryptocurrencies. The introduction of XRP borrowing fills a gap that has existed in the ecosystem for years.

Additional access points beyond Mystic will become available over time, and this includes potential integration with Morpho’s main application as well. What’s particularly interesting about XRP borrowing is how it addresses the long-standing issue of idle capital. XRP holders who didn’t want to sell their positions had few options to put their assets to work, but this changed with the new lending and borrowing markets.

This modular approach to XRP collateral loans means that each market operates independently with its own risk parameters, so problems in one market won’t necessarily spread to others. This isolation is particularly valuable given the volatile nature of cryptocurrency markets and the concerns investors have about security risks.

Understanding the Mechanics of DeFi XRP Markets

The FXRP yield opportunities that are now available come from depositing tokens into professionally managed vaults, where curators like Clearstar select which markets to allocate funds into based on risk and return objectives. The growth of DeFi XRP solutions on Flare represents a shift in how XRP holders can interact with their assets.

For users who need liquidity but don’t want to trigger a taxable event by selling, XRP borrowing against their holdings provides an alternative that keeps their long-term position intact while unlocking capital for other uses. With XRP borrowing now accessible through multiple vault options, holders finally have more control over how they manage their assets.