Goldman Sachs’ exposure to XRP has caught the eye of the cryptocurrency community. Ripple’s cryptocurrency had taken a backseat due to the long-standing bear market. But the banking giant’s inclination towards the asset strengthens the possibility of a major repricing event.

This narrative came to light after commentary on social media pointed out how Goldman Sachs had invested in XRP along with other crypto assets. While the details remain limited and no direct large-scale spot holdings have been formally confirmed, the idea alone was enough to trigger fresh debate across the XRP community.

Also Read: Is Trump Pushing the World Toward China and Global De-Dollarization?

Institutional Allocation Revives XRP Repricing Event Narrative

It should be noted that institutional involvement has always been central to XRP’s long-term narrative. For instance, Bitcoin (BTC) was mostly built to bring in a system that is free from government oversight. But XRP was launched around payment settlement, with Ripple acting as a bridge between banks and financial institutions. As a result, XRP certainly stands out in the crypto crowd.

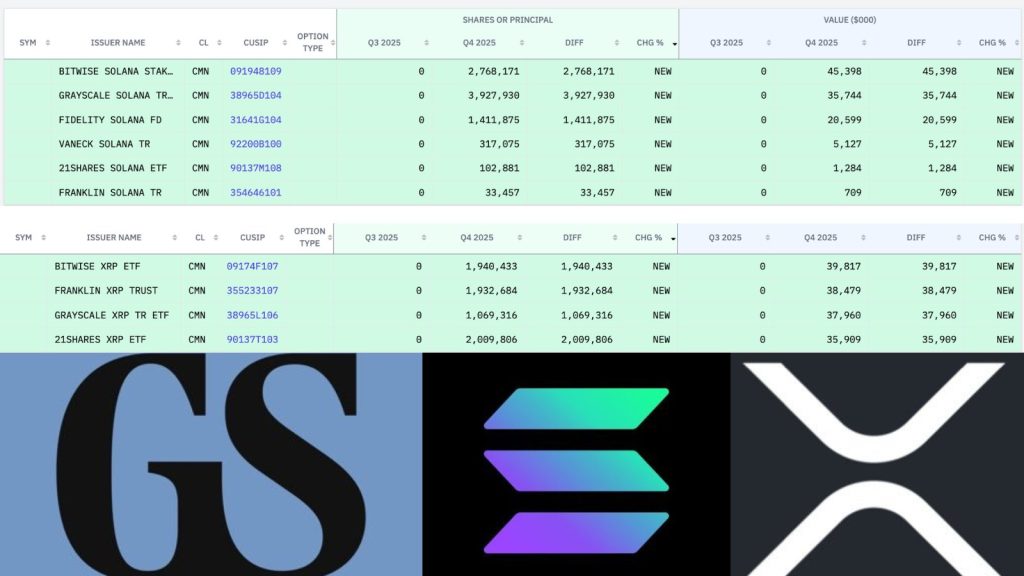

That said, Goldman Sachs continues to hold other assets along with XRP. This includes about $1.1 billion in Bitcoin, $1 billion in Ethereum (ETH), $153 million in XRP, and $108 million in Solana (SOL). Even though the banking giant holds a comparatively smaller portion of XRP than BTC and ETH, its inclusion has made headlines. This prompted extreme projections, including the XRP $1,000 target.

Also Read: Costco Returns Crackdown: Is COST Stock Protecting Margins?

Can This Alone Take XRP To $1,000?

XRP’s position in Goldman Sachs portfolio is definitely a bullish sign. Crypto commentator Xaif also called the allocation a signal of relevance rather than neglect. He further suggested that XRP’s liquidity and continued use in payment systems are driving institutional interest in the altcoin.

Another factor that is expected to drive the price of XRP is the entry of Ripple’s CEO, Brad Garlinghouse, into the CFTC’s Innovation Advisory Committee. The altcoin saw a 10% rise following this news. But this increase was short-lived. Still, the appointment marked a shift in tone.

At press time, XRP was trading at $1.50 following a 6.1% drop over the past 24 hours. The asset’s weekly price change stands at a positive 7.7%.

After several years of legal battles, Ripple is now part of policy discussions shaping crypto regulation. For many investors, XRP’s presence in the CFTC committee signals growing institutional relevance. This has also brought the XRP repricing event narrative back into focus.

Price Prediction

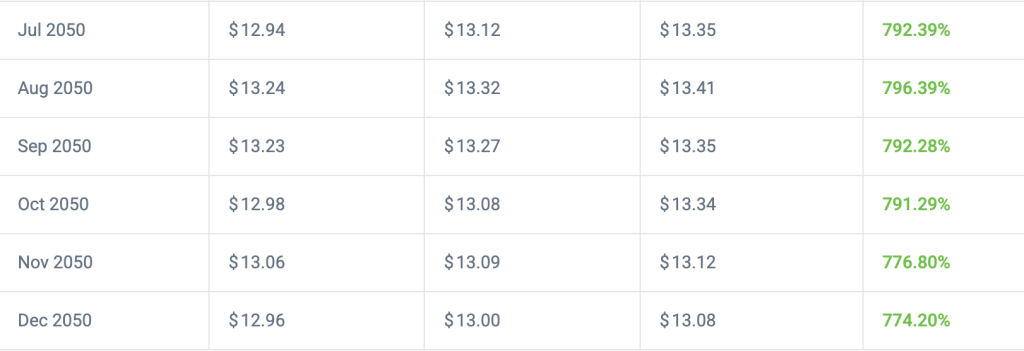

Considering the asset’s current price point, the real question is, will XRP reach $1,000 anytime soon? It should be noted that the altcoin should surge by a staggering 66,567% to hit $1,000. According to data from CoinCodex, the highest level that XRP would trade at in the next 25 years is $13.41. Ripple’s cryptocurrency is set to reach this peak in August 2050.

While the repricing narrative has returned, the chances of XRP reaching $1,000 seem bleak at the moment. But increased adoption, market conditions, and institutional involvement could be major drivers.

Also Read: X Set To Launch Crypto And Stock Trading With Smart Cashtags