Evernorth Holdings is currently grappling with a substantial hole in its balance sheet. According to Yahoo Finance, “Evernorth’s unrealized losses have increased steadily over the past few months. The figure now exceeds $380 million as XRP trades below $1.50.”

Evernorth’s Losses on XRP’s Holdings

The value of Evernorth has declined compared to when it first purchased 389 million tokens worth $947 million. Cryptobriefing reports that the current market value of the XRP stash is roughly $220 million less than what Evernorth paid for it.

The losses at Evernorth coincide with a broader rout in the XRP market and larger cryptocurrency market. On Thursday, the XRP plummeted to a 15-month low with a 10% drop and is now trading at $1.42. This marks its weakest performance since the U.S. elections in November 2024.

Analysts note that the XRP coin has lost key technical support levels amid this downturn, intensifying near‑term selling pressure.

“The recent fall also saw XRP lose its critical support at $1.60, a key level during the April 2025 selloff, signaling that sellers have regained control,” according to Coinspeaker. Popular crypto analyst Crypto Patel noted on X that “XRP has now declined roughly 58% from its all-time high.“

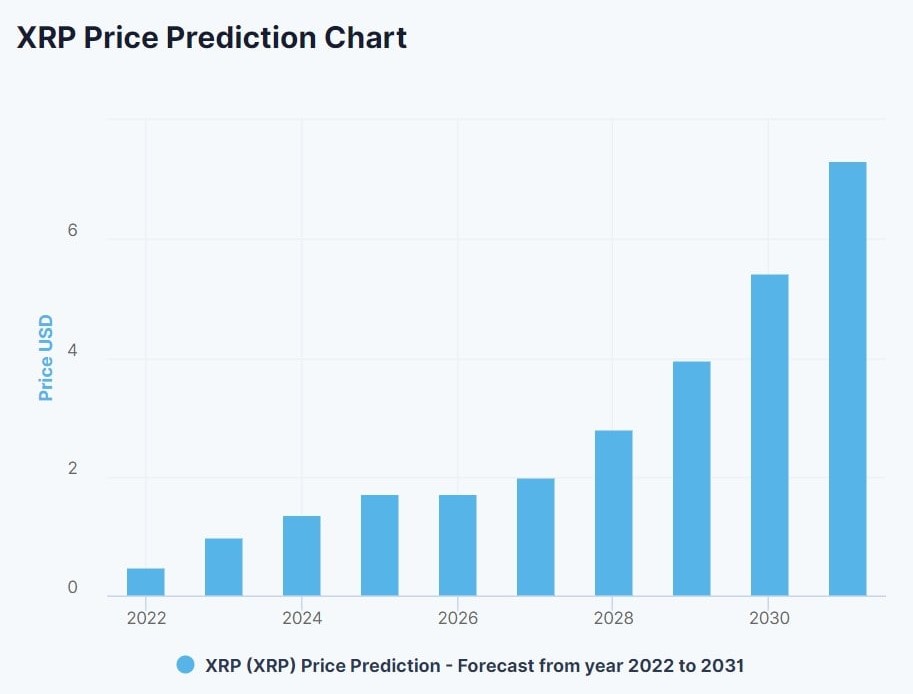

XRPL and XRP Price Predictions

Stormgain’s long‑term forecast illustrates how XRP could recover gradually over the coming years, even after its recent downturn.

Despite the current price suppression and corporate losses, a structural shift is looming. How the Ripple’s coin is utilized may dictate its long-term trajectory.

According to recent Nasdaq analysis, Ripple’s coin needs to go through real-world asset (RWA) tokenization. This means “representing ownership of an asset like a stock or a property as a crypto token that can be transferred and managed via a blockchain, like the XRP Ledger (XRPL).”

Nasdaq argues that, “The point of tokenizing assets is that they can settle 24/7, update their ownership records automatically, and support features like whitelists or asset transfer restrictions without a separate reconciliation step.”

With such a structure, Evernorth could represent its stocks as a token or XRP ledger for easier trading. In fact, “In late January 2026, public blockchains collectively managed a bit over $24 billion of tokenized RWAs, skewed toward government debt, tokenized commodities, and private credit,” reports Nasdaq.

As for XRP’s price prediction, the same source reports that: “The edge that XRP has here is its compliance tooling, so it could ultimately be viewed as much more attractive for financial institutions than its competitors“.

XRP is down sharply, but the growing push toward tokenization on the XRP Ledger keeps the long‑term narrative alive.