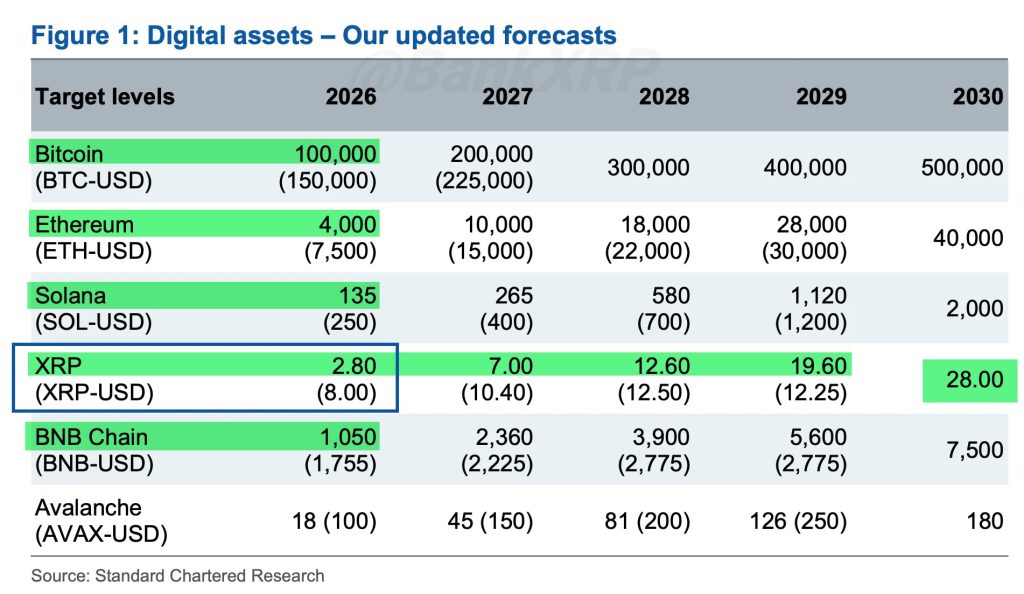

Standard Chartered has sharply lowered its long-term outlook for XRP. The bank has cut its XRP price forecast for 2026 from $8 to $2.80. This revision is a notable shift in sentiment from last year. During this period expectations were tied to strong institutional demand and ETF-driven inflows.

Also Read: Precious Metals Price Prediction: Gold Could Hit $7K-$8K by May 2026

Standard Chartered XRP Analysis Cuts 2026 Price Forecast to $2.80

The latest downgrade came from Geoffrey Kendrick, the bank’s global head of digital assets research. In his note, Kendrick pointed out the weakening institutional flows and broader market pressure as key reasons behind this revised prediction. XRP has struggled to maintain upward momentum in recent months, trading closer to the $1.40-$1.50 range.

XRP ETF outflows were a central factor in the revised prediction. Kendrick described the current phase as a period of “ETF fatigue.” He believes that institutional investors are stepping back after earlier inflows helped drive price rallies. There has been a sharp drop in XRP ETF holdings. Assets tied to XRP fell from $1.6 billion to $1 billion in recent weeks. This downfall further supports Standard Chartered’s view.

Alongside XRP, Standard Chartered’s analysis cut its Bitcoin (BTC) and Ethereum (ETH) forecasts. According to Kendrick, BTC’s revised prediction for 2026 was pushed from $150,000 to $100,000, and ETH went from $7,500 to $4,000.

Also Read: Morgan Stanley Hires Blockchain Engineers for Multi-Chain Integration

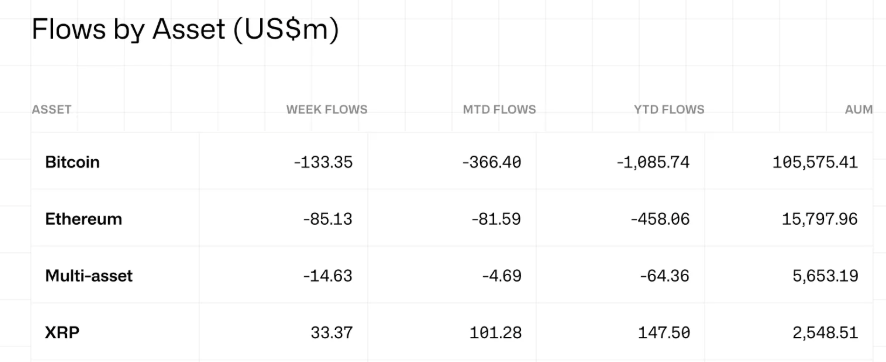

On the contrary, institutional flow data shows XRP is holding up better than other major assets. Data from CoinShares reveals that XRP investment products recorded $33.4 million in inflows last week, while Bitcoin saw $133 million in outflows and Ethereum lost $5.1 million. Sentiment towards XRP seems to remain relatively resilient despite Standard Chartered’s prediction.

In addition, macro conditions also have an impact on this sentiment. Kendrick noted how mixed U.S. economic data and delayed expectations for interest rate cuts could limit institutional inflows. That environment may make it harder for XRP to attract fresh capital. Kendrick added,

“I think we are going to see more pain and a final capitulation period for digital asset prices in the next few months. The macro backdrop is unlikely to provide support until we near [Kevin] Warsh taking over at the Fed.”

How is XRP Faring Right Now?

At press time, XRP was trading at $1.47 following a 0.42% rise over the past 24 hours. The altcoin experienced a fairly strong week, rising by 3.3% over the past seven days. In order to reach $2.80, XRP has to rise by nearly 90% from its current price level.

Also Read: $500M UAE Investment in Trump’s World Liberty Financial Triggers Probe